Landlord Boiler Insurance

We can offer cover for boiler breakdowns at your residential rental property.

- Available as part of your Towergate landlord home emergency insurance

- Get covered and your documents on the same day

- Access your quotes, policies and renewals in your online account

Call us on 0800 107 8949

One of the UK's leading independent insurance brokers

Easily compare quotes

From our panel of trusted brands

Why choose landlord boiler cover with Towergate?

Annual boiler cover up to £1,000

Landlord boiler cover for up to £1,000, over 12 months

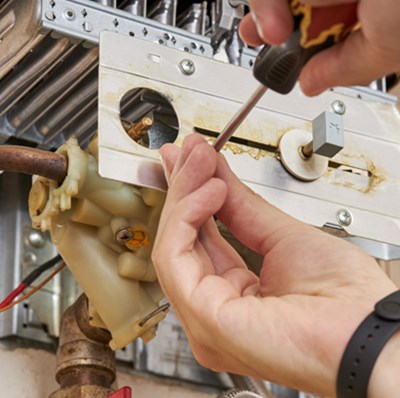

Cover emergency heating repairs

Emergency repairs to your property’s primary heating system sorted quickly

24-hour helpline for boiler cover

Access to a 24-hour helpline and network of reliable UK tradespeople

Immediate landlord boiler cover

Call today for a landlord insurance quote with boiler cover

About landlord boiler cover

Pay for landlord boiler cover by Direct Debit

You can choose to split your payment into 10 monthly instalments.

Landlord home emergency insurance

Landlord home emergency insurance, not only covers boiler emergencies but also other domestic disasters, such as blocked drains or pest infestations.

24-hour helpline for landlord boiler cover

If the boiler breaks down at your property, and you’ve got cold and disgruntled tenants, you need things sorted out as soon as possible. With landlord boiler breakdown cover you’ve got access to a 24-hour helpline, and a national network of reputable tradesmen who can get things fixed, fast.

Keep your tenants happy with landlord boiler cover

If you don’t want to be frantically calling emergency plumbers in the middle of the night on a Sunday, a landlord boiler breakdown policy takes the heat off you – and hopefully restores it to your tenants quickly and easily. Your tenants get a speedy service, and you get a good night’s sleep.

When you need to make a claim, we'll guide you through the process and get your claim settled as quickly as possible.

- Find your insurance documents and make sure you have all your information at hand, including your policy number.

- Call the claims team on 0344 892 1384 and explain exactly what happened.

- Provide photos if requested to help us understand what happened as quickly as we can.

Ready to get covered?

- Fill in our online quote form or call us

- Select your insurer and price

- Relax - You're covered!

Landlord insurance FAQs

We may not be able to insure really old boilers, or boilers that haven’t been serviced every year. It’s also only for emergencies – so if the problem isn’t going to cause damage to your property or significant inconvenience for your tenants, it’ll have to be dealt with under your general landlords insurance terms and conditions.

You can’t buy landlords boiler cover by itself. It’s an add-on you can choose when you buy a landlords insurance policy.

Yes, you can get more cover for your boiler and other home emergencies. We also offer home emergency insurance, which will cover not just the primary heating system, but your drainage system, security, and more.

While landlord insurance is not a legal requirement, your mortgage lender may require that you do so. Also, the responsibilities in your tenancy agreement may be best served by an insurance agreement, especially to avoid putting your financial future at risk.

We can provide a range of landlords insurance policies, including for residential, commercial, mixed-use and multiple premises.

The cost of your landlord insurance will depend on many factors. Everything from the type of cover you need, to the property’s location, construction, occupation and values to be insured.

First, you’ll need to choose between building or contents insurance, or a combined landlord insurance including both buildings and landlord’s contents, before setting your specific levels of cover. The type and level of cover you opt for will have an influence on the cost of your insurance.

The size, style and even the roof of your property will also have an impact on how much you pay for your policy. No matter what kind of property you own, your insurance policy should include protection for the rebuilding costs at today’s prices and associated property owners’ liability. Remember, rebuilding costs can amount to far more than the market value of your property.

If the worst happens and your property is destroyed by a fire, you’ll need to allow for a variety of additional costs, including:

- Debris removal

- Site clearance

- Architects and surveyors’ fees

- Planning permission

- Other legal and professional fees

- The possibility that your VAT status may affect your building sum insured. i.e. do you include or exclude VAT in your rebuilding valuation?

Landlord insurance can cover you for loss of rent receivable while your property is uninhabitable, ensuring you still have money coming in until your tenants can move back in. Its important to consider the length of time it will take to fully rebuild the property and ready for full occupation once again. This period is called the maximum indemnity period, and you should take care when assessing this. The minimum period available for loss of rent is normally 12 months, but we recommend longer periods are arranged for at least 24 months, allow for unexpected delays that often occur. Specialist or listed properties can take even longer to rebuild, so it’s important to seek guidance from your surveyor and insurance advisor.

Your landlord insurance will also be affected by the tenants you’ll be welcoming. For example, if you’re going to be renting the property to a professional couple, you may well find that your cover is cheaper than if you’re planning on letting to a group of students.

Previous claims and the number of properties you insure will also influence the final cost of your insurance, together with any optional additional covers that you may wish to arrange e.g. home emergency cover.

Yes. If something happens to your property, it may not be possible for your tenant to live in the premises, which of course means that you’re likely to lose out on some rent.

You can claim for that loss of rent if your building is uninhabitable as long as the damage or an accident (such as fire, storm, flood or escape of water) is covered by the rest of the policy. Just let us know your annual rental income and an idea as to how long it would take to rebuild your property in the most serious of incidents.

Whilst our online insurance portal offers suitable cover to a large proportion of our landlord customers, we always advise speaking to our advisers directly if you have anything out of the ordinary if you want specific cover for something or want to discuss ways to get cover even cheaper. We can often discuss lowering areas of cover you may not need, or want, or help you source a discount.

As a specialist broker, we pride ourselves on understanding our customers’ needs and finding them a policy that offers the most suitable landlord insurance, at the right price. However, sometimes this is best done over the phone.

Unfortunately, things don’t always go to plan, and landlord insurance can provide cover for a wide range of insured perils putting your property at risk. Core cover typically includes loss or damage caused by fire, lightning, aircraft, malicious damage, explosion, escape of water, storm or flood, impact, accidental damage or subsidence.

There are many reasons to protect yourself with landlord insurance, such as peace of mind or to meet contract requirements from banks or building societies specifying insurance cover against a loan or mortgage. In addition to the core insurance perils, property owner policies can include a range of different extensions. These are summarised below.

- Damage caused to landscaped gardens by the emergency services

- Loss of metered water as a result of damage caused by an insured peril

- Disposal of wasp nests

- Unauthorised use of electricity

- Trace and Access

- Damage to the building due to theft or attempted theft

Please note that the exact cover extensions and limits provided do vary between insurers, so it’s important to check the policy wording and speak to your advisor to ensure your demands and needs are fully identified and protected.

Whilst it is not a legal requirement, the risks of not having landlords insurance are significant if something goes wrong. Some mortgage lenders will require that you take out landlords insurance before you invest in a buy to let property, and it can provide peace of mind that your property is protected.

Landlord insurance can cover you if your tenants damage your property, or if they suffer an accident on the premises.

Landlords are responsible for building insurance, contents insurance and public liability insurance. Landlords can also benefit from additional policies such as rent protection, accidental damage and unoccupied property cover.

Buy to let insurance can cover a range of tenancy types, including lets for professionals, students, DSS tenants, sub-lets and family lets. When you take out your policy, you may choose to add additional cover options too.

Landlord insurance covers you for similar perils to those covered by a standard home buildings insurance. They are events such as fire, floods, escape of water, subsidence etc. As a landlord you will have additional needs such as cover loss of rent and alternative accommodation.

Other complimentary covers are also available for landlords, including home emergency and landlords legal expenses insurance.

These covers are available via our online quote system or from our team of advisors who will be able to discuss your requirements and find something that suits your needs exactly.

Every landlord is different, and there are a variety of insurance products to choose from, depending on whether you are a commercial or a residential landlord or a mix of both, or if you own a single property or multiple properties.

For a landlord with a property portfolio, we can arrange a single policy to cover all properties. Saving you time on administration with a single renewal date and an one annual premium. It's very flexible, as adjustments can be made at any time to add or delete properties.

A further benefit of most buildings insurance policies is an extension for accidental damage caused to underground services for which you are responsible. For example, should a heavy skip lorry drop a skip on your driveway, accidentally damaging water pipes or cables beneath, you could be liable for any repair costs incurred, if you are unable to recover from the lorry operator. This would be a potential damage claim under your policy subject to the excess applicable (normally £100 but can vary between different policies).

We’ve a range of buildings and contents insurance available to you via our panel with excesses as low as £100. This will cover you for escape of water, accidental damage, fire and more. Malicious damage can also be covered if required.

If your property has a history of subsidence, we can cover you here too. All we ask is that you get your property inspected and provide your engineers report so we can apply the correct cover.

Watch our video below:

If you need cover for subsidence, we can provide it. However, there is a 'but' – if your property has a history of subsidence we’ll require an inspection of the property to establish the risk of further damage before we provide cover.

All insurers are wary of properties with subsidence, even if it was 10 years ago, but usually we won’t have trouble finding you insurance as long as you can provide the correct paperwork to prove the initial cause has been dealt with and subsequent checks have been made. Speak to us on the phone, or via email, and we can discuss your options with you.

As tenants come in all shapes and circumstances, we’ll go out to our panel and find you a suitable policy. We can provide insurance for all sorts of different tenant types including DSS/DWP tenants and students, professionals, local authority placements and asylum seekers, and our cover also extends to bedsits. We build the cover to suit your needs: many insurers won’t provide cover but we have access to a wide range of insurers and know the insurers that do.

If you require cover for a sub-let you may require a slightly different type of cover and one of our advisers will happily point you in the right direction.

Yes, we specialise in finding insurance policies for landlords with multiple properties. In fact if you have between 1 and 50 properties we can often find you discounts on the policies and the administration fees. By insuring all properties under a single policy, you will have just the one insurance policy on one renewal date and one premium to pay. We can provide a breakdown of the premium so that you can split this amongst your properties.

We can also include any new policies mid-term so you can keep the same renewal date for all your properties in a single portfolio.

Additionally we reward landlords with more than one property and those with a good track record by taking into consideration the number of years of experience. Insuring all your properties under one policy allows you to save on admin fees and receive discounts for every property you add.

As these policies are a little more complex, it’s best to get in touch with us by phone so we can provide efficient and relevant help.

HMO landlord insurance is insurance for landlords who rent houses in multiple occupation. Terms are slightly different to those of a regular landlord insurance policy and you will need to register the property as an HMO in order to get a HMO insurance policy. Thereafter, it’s very similar to a standard landlord insurance policy and can cover property owners' liability, risks to the building and risks posed by tenants.

The cost of landlord HMO insurance can vary considerably depending on the size of the building, number and of tenants, and more. Experienced landlords, like those who offer DSS property rental are likely to get a discount on Towergate policies and equally, if you have multiple properties, like a block of flats, we will usually be able to get you a better deal. Speak to the team to find out how we can help.

An HMO, also commonly known as a house share, is a property rented out to at least three tenants who are from different households but share facilities such as the bathroom and kitchen. In England and Wales, you must have a HMO licence if your property is a large HMO, in which the following all apply:

- You are renting to five or more tenants who form more than one household

- At least one tenant pays rent

- Some or all of your tenants share bathroom or kitchen facilities

In some areas you may still need a licence even if you have fewer than five tenants, so it is important to check with your local council. This licence is valid for five years, and you will need one for each HMO you run - otherwise you could face an unlimited fine. As well as obtaining the appropriate licence, as a landlord of a HMO you must:

- Ensure that the property is suitable for the number of tenants

- Ensure that the property’s manager (this could be you or a letting agent) has no criminal record or history of breaching landlord laws

- Send a copy of your annual gas safety certificate to the council every year

- Provide safety certificates for all appliances in the property (when requested)

- Install and maintain smoke alarms in the property

Your council may also impose other rules and conditions for your licence. If you disagree with any of them, you can appeal to the First-Tier Tribunal. You will also need to make sure your property is correctly registered as a HMO before you can take out HMO landlord insurance.

The lease on HMO insurance properties is different and due to the number of people inhabiting the property, the address must be registered as an HMO residence. HMO insurance presents a considerably higher risk as there are multiple occupants, it requires that the premises must be the occupant’s main place of residence or used by students during term time.

Owning a building without building insurance leaves you very exposed to large potential losses arising from a serious fire, storm or flood. It’s not just the damage to the building that must be considered. What about the loss of rental income you would suffer during the period the property cannot be occupied?

Re-building a property following a large fire can be a complicated and extended matter for a whole variety of reasons. Planning and unexpected delays caused by weather or a shortage of building materials which is very common following the covid pandemic can extend the rebuilding periods. This can run to 24 or 36 months, so it’s very important to take this fully into account. In some listed properties, there can be unexpected archaeological finds whilst excavating foundations which cause additional unexpected delay, due to the historical interest created.

Taking out landlord insurance isn’t a legal requirement, but most mortgagors for buy-to-let properties will require you to arrange a buildings insurance policy as a protection against amount of the mortgage or bank loan arranged.

Renting out a property comes with its own unique set of risks. Without landlord insurance to protect you, you’re vulnerable to loss of rent and any legal claims from members of the public for accidental bodily injury or damage to their belongings arising at the property.

Yes, you can pay your landlord insurance in instalments. To help you spread the cost of your premiums, we offer a quick and easy direct debit scheme for spreading payment over ten months. Please visit our dedicated Direct Debit page to find out more.

If you would like to know more about our monthly payment option, please visit our dedicated Direct Debit page.

A lot of landlords with coach houses to rent find it a struggle to get the right cover (or any cover at all) with high street insurers or online. Because we have extensive access to the insurance market and good relationships with the insurers themselves, we can find coach house policies that others can’t. You will need to speak directly to one of our advisers though!

These certificates show the energy performance of a building on a scale from 'A' to 'G', with 'A' being highly efficient and 'G' being a very low efficiency which is not suitable for habituation. You can use these certificates to estimate your average energy running costs for the near future - which is especially useful to landlords who rent out their properties with bills included.

If you are asked by an inspector to produce a valid EPC and your property does not have one in place, you could risk a fine of up to £5000 depending on the type of property.

If your property is located in England, Wales, or Northern Ireland and you are unsure whether your property has a valid EPC in place, you can check online for free. If it is located in Scotland, you can check for its EPC here.

If you need an EPC, you should arrange for an accredited assessor to visit the property. You can find more details here. Once you have received your EPC, it will be valid for ten years.

It is currently illegal to rent out properties with an 'E' efficiency level or below. The UK government has also announced plans to enforce all new tenancies to have a “C” efficiency level by 2025, stretching to cover all rented properties by 2028. So even if you already have a valid EPC, you may need to take steps to improve the efficiency of your property, such as changing windows and doors, replacing boilers and radiators, and improving insulation.

While this change has not yet been enshrined in law (as of April 2022), rising energy costs mean that making upgrades to improve your property’s energy efficiency is something you may want to consider sooner rather than later.

Yes. We can cover replacement of locks should your keys be lost or stolen. and damage from an emergency access.

As long as the building is on the deeds to the property, be it a garage, out building or annex we’ll be able to help you find the right landlord insurance policy to include this.

We can provide insurance to cover malicious damage by tenants however this doesn’t necessarily come as standard on all policies. Make sure you ask us for it when you call us or get a quote online.

With malicious damage cover for tenants in place, should a tenant deliberately damage your building or your contents, you’ll be able to claim and we’ll do our best to recover the cost of the damage caused. So, for example if a tenant spray paints your walls or slashes your sofas, we’ll sort it for you.

Landlord insurance covers you for similar perils to those covered by a standard home buildings insurance. They are events such as fire, floods, escape of water, subsidence etc. As a landlord you will have additional needs such as cover loss of rent and alternative accommodation.

Other complimentary covers are also available for landlords including Home Emergency and Landlords Legal Expenses insurance

These covers are available via our online quote system or from our team of advisors who will be able to discuss your requirements and find something that suits your needs exactly.

While it is not a legal obligation for engineers to produce a Gas Safety Record for every safety check or servicing they carry out, it is a legal obligation for landlords to obtain one.

Under UK law, landlords must arrange annual safety checks on all gas appliances (by a Gas Safe registered engineer) in their rental properties, and obtain a copy of the Gas Safety Record. You must also provide a record of this safety check to your tenants.

Buy to let insurance can cover a range of tenancy types, including lets for professionals, students, DSS tenants, sub-lets and family lets. When you take out your policy, you may choose to add additional cover options too.

An Electrical Installation Condition Report (EICR) is a report carried out to assess whether or not a property’s existing electrical installation is in a safe and serviceable condition. The report will detail whether the property is in a satisfactory or unsatisfactory condition, as well as indicating any areas that require immediate attention or improvement.

In the event of an unsatisfactory report, you have 28 days from the date of the inspection to ensure the necessary work is carried out by a qualified person. You must then submit both written confirmation of the work being carried out and a copy of the original report to your tenants and the local housing authority.

The UK government requires that all tenancies must have the electrical installations in their properties inspected at least every five years, and landlords must produce a copy of the electrical safety report to their tenants and local authority if requested. If found within breach of your duty as a landlord, you could risk a fine of up to £30,000.

Landlords are responsible for building insurance, contents insurance and public liability insurance. Landlords can also benefit from additional policies such as rent protection, accidental damage and unoccupied property cover.

If you’re not a pet friendly landlord yet, it may be time to reconsider your stance. One of the main sticking points when it comes to choosing a property to rent is whether it welcomes pets – as Rightmove reported that being pet-friendly was the most sought-after property feature in 20211.

Many tenants know that they’re going to be renting for the foreseeable future, and they’re no longer willing to put off investing in a pet in the hope that they may own their own property one day.

With more professionals working remotely post-pandemic, we’ve seen a huge number of people welcoming a cat or a dog into their household as they’re now around more during the day. In fact, according to the Pet Food Manufacturer’s Association, households bought 2.3 million pets during the pandemic. The demand for pet friendly rental properties is rising sharply every year, so it might just be worth becoming a pet friendly landlord if you want to appeal to a wider pool of tenants.

Choosing to rent out your property to pet owners is a big decision, and recent figures from the government show that only a tiny 7% of landlords are willing to accept our furry friends. That means if you choose not to accept pets at your rental property, you could be missing out on a large slice of the pie when it comes to attracting potential tenants.

One of the most common challenges for landlords is finding tenants to stay long-term. As people who live with their pets are likely to stay longer, renting out your property to tenants with a pet in tow could be a wise decision. Your tenants may start to consider moving on when they want to buy their first pet, and the option to have one as soon as they’re ready will help your tenants to view your house as their proper home.

It may sound drastic, but wheels are in motion in parliament to make it more difficult for landlords to say no to pets. Conservative MP Andrew Rosindell is calling for a change in the law that will make it easier for pet-owners to rent. Currently, the Tenant Fees Act prevents landlords from requesting a higher deposit from tenants who have pets.

This is making landlords more reluctant to accept pets, and we’ve seen fewer landlords choosing to be pet friendly since the Tenants Fees Act was passed in 2019. Some landlords choose not to accept pets at all, while others add an increase to the rent to cover any potential damage caused by the pets.

As a result, a group of MPs and House of Lords peers are calling for change, lobbying for pet deposits to be added to the list of permitted payments and for the issue of pet insurance to be reviewed. A report submitted by Mr Rosindell found that 53% of tenants with pets said they would be happy to take out pet damage insurance if it meant they could rent a property.

The latest plans published from the government will make it more difficult for landlords to ban pets from their properties. The Fairer Private Rented Sector White Paper published in June 2022, includes a proposal that will mean landlords must consider allowing their tenants to keep a pet when they request permission to.

Landlords will also be unable to refuse the request without reasonable grounds. The proposal signals a huge change in the rights of tenants to keep pets.

You must pay your tenant’s deposit into a government-backed Deposit Protection Scheme within 30 days of receiving it from the tenant. There are two types of scheme:

Custodial scheme

For these schemes, you must submit the full amount of the tenant’s deposit, where it will be protected until the end of the tenancy. At the conclusion of the tenancy, both you and the tenant can contact the scheme administrator to request the release of the funds.

If a dispute arises due to damage or loss, the money will remain in the scheme until you and the tenant agree upon a resolution - this could be in the form of deductions from the deposit, or a court order.

These schemes are usually free of charge.

Insurance-based scheme

Insurance-based schemes allow you as the landlord to retain the deposit in your own bank account during the tenancy, although you must pay a premium for this. You can use the funds however you wish, but must repay the amount to the tenant at the end of the tenancy.

If a dispute arises, the disputed amount is moved to the deposit protection scheme until a resolution is reached. If you fail to return the money to the tenant, the scheme will pay the tenant directly before proceeding with you.

A tenancy inventory is a report, often including videos or photos, that documents the property and its contents as well as their condition. These inventory reports are carried out both before a tenant moves into the property and when they move their belongings out of the property. They are crucial for both landlords and tenants, as they are used as evidence in disputes over the return of the deposit. Taking as many photographs and videos as you can will help you in the event that a tenant damages or steals anything from your property.

Your inventory report should include:

- Names and addresses of the landlord and tenants (and letting agents if necessary)

- The date the report was conducted, and the name of the person who conducted it

- A list of all items, decor, fixtures and fittings (both exterior and interior) and their condition

- Photos of the items

- Signatures from both the landlord and tenant agreeing to the inventory’s contents

As a landlord, you are responsible for most repairs to the exterior or structure of a property - including the roof, chimneys, windows, doors, walls, guttering and drains. Just like any property, it is important to make sure you have the relevant insurance in place to protect you in the event of fire, floods, escape of water, or subsidence. Towergate’s landlords insurance also offers cover for loss of rent and alternative accommodation.

You are also responsible for arranging safety checks and repairs on boilers, so it is advisable to take out landlord home emergency cover as part of your landlords insurance, which will ensure that your boiler will be fixed promptly even if it breaks down in the middle of the night.

Landlords are also responsible for repairing:

- basins, sinks, baths and other sanitary fittings including pipes and drains

- heating and hot water

- gas appliances, pipes, flues and ventilation

- electrical wiring

- any damage you cause by attempting repairs

In emergency cases such as leaking pipes, lost keys, pest infestations, or failure of central heating, your landlord home emergency insurance can help cover you. In cases where the tenant is directly responsible for damage (such as broken furniture or blocked drains), you can obtain the cost of repairs from them (although this does not apply to general wear and tear).

Pre-vetting your potential tenants is a vital step in renting out your property. Read our guide to a landlord checking service

Holding the correct licence for your rental property demonstrates that it is suitable for occupation and appropriately managed to an acceptable standard. As a landlord, it is a legal requirement to ensure that you obtain the correct licence for your property. The licence allows councils a level of control over the quality of landlords and rental properties in the area.

The rules for registering and licensing vary across the UK, but you can check if you need a licence on your local council’s website. If you let property in England, you will be subject to “selective licensing” - this means your local authority will have the power to introduce licensing for all privately rented properties in a given area.

If you've made use of landlord portals to let your rental properties, then you know that an appealing advert is all-important.

The difference between a property that's quickly snapped up and one that sits on the market isn't always about the place itself. The classified ad may not be doing your property justice.

Pricing your rental property

Price is the single most important factor when seeking out tenants. The best way to figure out whether your property is priced too high (or too low) is to do a quick search of the portals you're advertising on to see what similar homes are renting at. Settle on an average price that seems to yield success for properties like yours and see if that sparks any interest.

When listing your property, always round your price up or down to the nearest £100. This way, when someone searches for properties within a certain price range, you'll appear in more search parameters. For example, if you list your rental property at £600pcm, it will appear under both the site’s £500–£600 and the £600–£700 range filters.

Photos for a property advert

It goes without saying, but having a professional photographer take the photos for you goes a long way when you're trying to catch a potential tenant's eye.

Big, beautiful photos are the second most important part of your classified ad. You need to hook potential tenants, and that means showing off your home's best features. To do this, make sure all the rooms you photograph are clean and well-lit. You should try to capture as much of each room as possible and choose each shot carefully to show off the best angles.

At the very least, you'll want photos of your kitchen, living room, master bedroom and bathrooms. You'll generally want 6–10 high quality photos—one photo per room. For your lead photo, consider showcasing your best quality photo. If possible, make it one of the home's main selling features e.g. the kitchen.

House features

Installed a new boiler? Fixed the shingles? It pays to list any work you've done and/or any novelty features your house might have. Make a bullet point list telling tenants about...

-

Recent renovations/refurbishments

-

Character appeal (e.g. exposed wooden beams, wood-burning fire places, etc.)

-

Nearby parks/rivers/shopping centres

-

Proximity to important locations (Universities, transit, landlord, etc.)

-

Parking accommodations

-

Security features

-

Storage space

-

En suite bathroom

-

Low tenant fees

-

Pet-friendly

-

Smoke-free

Writing a description for a property advert

You'll want to lead with a description that succinctly describes (and upsells) your property. Include the important information tenants want to know, such as:

-

Date the property is available

-

Number of bedrooms

-

Number of bathrooms

-

Whether the property is furnished/unfurnished

-

Rent/utility details

-

Energy certificates

Obviously you should aim to sell your property to your ideal tenant, which means describing specific features that might appeal to them. For example, if your house is located near a university, describe the short commute and highlight all the local pubs and hot spots. If you want to rent to new families, describe nearby parks, schools, and community centres.

The key here is to understand your audience and adapt your advert to give them the information you think they’d like to see.

Getting a floor plan of a property

When tenants look at classified ads, they're hoping to get a sense of a home's size and layout. Many prospects won't even click on an advert that doesn't include a floor plan.

Fortunately, there are many programs available that allow you to create a floor plan for yourself. Examples include free browser-based software by RoomSketcher and Homestyler.

We're here to help

Whether you advertise through a letting agent on portals like Zoopla and Rightmove, or you're listing your own property on portals like Gumtree and Rend Direct UK, it's essential that your advert appeals to potential tenants and piques their interest.

Tackling the task of successfully listing your property is a great start. But if you’d like to hear more information on how we work with landlords, you can contact us anytime.

Expense, time, administration and possible loss of income - As a landlord you know that turning over your property does not grow your business, make it more efficient, better marketed or improved at all. If your tenants are good, trustworthy, timely in paying rent and long staying then there are simple steps you can take to encourage continued business with them.

Your tenants are your businesses customers. If you want returning business and brand loyalty – it must be earned.

Choose carefully

Don’t go into business with someone you aren’t sure about – trust your instincts when you meet your tenants. Do you connect on a personal level? Can you see yourself dealing with this person for the long term future, on a regular basis?

Perform proper background checks. Don’t ignore the flagged results but don’t forget that nothing is clear cut – did you consider voicing your concern to your prospective tenants as a way to get to know them?

The same goes for your agency, contract workers, handy men and anyone else who represents your business. If your tenants don’t deal directly with you, how do the people they do deal with hold up? Is your agency efficient, polite, helpful and personable? Do the handy men deliver on time and to a high standard? If you trust your livelihood to outsourced agencies, be sure are they representing your business successfully, if not it could cost you some great tenants.

Communicate and respond quickly

The business of providing a functioning residency is a service you should take pride in. If there is an issue with the property or service, or of course, the payment or behaviour of your customers these should be dealt with fairly and promptly. A sure fire way to lose your tenants is to delay responding to them or hold off dealing with problems they are having.

Quality goods, materials and maintenance

Simply put - The better standard your property is in the higher standard of tenants you will attract and the higher bracket of rent you can charge. If you imagine that the property is your own residence, would you be willing to pay good money to rent it? It’s up to you what the quality of the service you provide is but of course it’s up to your customers to use your service.

Raising prices

Assuming you have quality, long-term renting tenants that you risk losing from raising the rent, how will the extra income balance in comparison to the costs incurred and loss of income during a change of tenants, not to mention the possibility of letting to tenants that aren’t as good as your current ones. Of course not all price changes can be avoided but it’s worth understanding the act between the possibility of more or less income against the benefits of quality tenants and longer tenancies.

Renting a property is a business, and with all businesses you need to decide on the type of customers you want to target. This standard is set by the tools you use, staff you hire and quality of service. Keeping hold of good tenants can be as simple as providing them with a service they are happy to keep paying for.

Watch the video to find out more…

Transcript

Whether you have a buy-to-let property or a portfolio of properties, landlord insurance, buy-to-let insurance and commercial landlord insurance are vital to protect your investment and income.

But because of the variety of circumstances and needs of each landlord it’s important to have a policy which is right for you.

Priorities can change over time so it’s important there is flexibility in your policy so it can grow with you and your business. Therefore, as a landlord you want to be able to choose who you rent your property to, whether they are professionals, students or DSS tenants.

Similarly, as you take on more properties you may want to take on more responsibility – or of course remove some of it, so you may what to change the way you manage your properties, whether that be as private rentals or let through an agent.

It’s then important your landlord insurance policy is flexible enough to accommodate this.

As someone with multiple properties, who relies on the income from rent, you may want to insure against ‘loss of rent’ or be able to claim for the costs of alternative accommodation for your tenants in the event of an insured incident such as fire. Follow the link below for our video especially on this type of cover.

It’s also important you are covered for the times when the property is unoccupied. This may be in a gap between tenants or during refurbishment. It’s important your landlord insurance covers these gaps as unoccupied properties face higher risks from flooding, storm damage and theft.

And lastly – as an experienced landlord with no history of claiming, you would want this to be recognised in your premium. Make sure to check with your adviser when getting a quote that a no claims discount is available.

For advice on landlord insurance or more resources on becoming a landlord, visit our website today.

It’s one thing looking for a property for yourself, but choosing the right buy to let is a completely different process. This is the time to put your own tastes firmly to one side and try to put yourself in your potential tenants’ shoes. The key to a successful buy to let investment is selecting a property that ticks as many boxes for renters as possible.

The more attractive it is to potential tenants, the higher the rental yield you will be able to expect and the more likely you are to enjoy long-term tenancies. The rental market has evolved rapidly in recent years, and tenants’ expectations and priorities have changed too.

So, what should you be looking for when choosing that buy to let property?

Your buy-to-let location is key

Before you choose a buy to let, take time to think about the kind of tenants you’d like to attract. The demographic you want to appeal to will have a big impact on the best location for your property. If you’d like to let your property to a family, you might want to go for a property close to a school.

Parents looking to rent with children may prioritise homes in school catchment areas, as well as those within walking distance from open spaces like parks, local doctors’ surgeries, and shops.

Whatever type of tenant you are looking to attract – bear in mind what they’re likely to need from a rental. For example, young professionals seek good transport links.

Always take time to ensure your property is in a safe area. Check out local crime rates in the area before investing, as you want your tenants to feel as secure as possible in and around their rental property.

Will you be a pet-friendly landlord?

We’ve always been a nation of pet lovers, but the pandemic saw a boom in new pets that’s now having a huge impact on tenants’ wish lists.

Rightmove reported that they saw website users searching for pet friendly properties above any other requirement during 20212, indicating that tenants are no longer happy to put off owning a pet until they buy a home.

Have a good think about the pros and cons of welcoming pets before advertising your buy to let, as it may widen your net when it comes to attracting tenants.

Think indoor and outdoor space

With more professionals working remotely, space is more important than ever. One forecast states that 1 office space in 10 will be surplus to requirements by 20273, so it’s looking likely that the changes in renters’ priorities we’ve seen triggered by the lockdowns may be here to stay.

With many people working from home most of the time or even full time, outside space and open plan living have become more important to tenants.

In 2021, Rightmove reported that demand for rental properties with outside space had soared by 39% since the previous year4, while demand for a balcony had risen by 70%. Space is becoming more important inside the buy to let too, as properties with open plan living are becoming more sought-after.

A flowing, open space offers tenants more choice when it comes to setting up a home workstation, and they’re great for family living and student set ups.

It’s all about the home office

Speaking of setting up a workstation, it’s worth bearing in mind that many tenants will be looking for an office space for remote working. This might be worth considering when you choose how many rooms your buy to let should have, as the spare room may well be converted into a home office.

Since the pandemic, rental homes that offer an office space have become just as attractive to tenants as those that have their own outside space. Does the location have access to internet service providers offering superfast broadband speeds?

That means you’re more likely to attract long-term tenants if you pick a buy to let that comes with a designated office area. The last couple of years have seen a quiet space for tenants to work remotely become increasingly important to renters.

Landlords insurance is designed for the protection of property owners who are renting to tenants. A tenant is a person or group who has a rental agreement in place allowing them to inhabit the property. The tenancy agreement will set out your responsibilities as a landlord and often will specify the requirements for you to have the correct insurance in place.

Landlord insurance protects you as the property owner from financial losses connected to the rental, such as theft, fire, or weather damage and can be extended to include coverage for things like unpaid rent and malicious damage by tenants.

While you are not under legal obligation to obtain landlord insurance, your mortgage lender may require that you do so. Equally, your tenancy agreement may require certain responsibilities of you that are best served by an insurance agreement, especially if you want to avoid putting your financial future at risk.

What is the difference between landlord insurance and standard home insurance?

You may not feel or operate like a business, but by earning money through rent, you are for insurance purposes classified as one. While buildings insurance is standard with both insurance types, home insurance is not always suitable for a property which is let out, nor is it designed for the needs of a landlord. There will be gaps cover and won’t cover you adequately for the liability, legal and loss of rent options available on a landlord’s policy. Furthermore, renting and not telling your home insurer could invalidate your home insurance. To protect your earnings and your material assets, it’s sensible to choose a landlord insurance policy as soon as you start renting out your property.

Professional let

A working person, couple or family who earn a living and pay their rent themselves.

Department of Social Security (DSS) tenants

DSS means Department of Social Security and refers to tenants who receive financial housing benefits from the council.

Not all insurers cover buildings occupied by DSS tenants, although it’s not difficult to find through any good specialist insurer. If you opt to rent to DSS you will see an increase in your premium, but many landlords choose this option because of the increase in potential tenants.

Students

Similar to DSS, student lets also demand a higher premium for many insurers, but your potential yield can be higher, just make sure your insurer is aware it’s students you let to.

Family members

It’s very common for landlords to let to a family member. For insurance purposes, you should have a tenancy agreement in place, even if in real life you operate less formally.

Sub-letting

Insurers generally don’t allow sub-letting. This is because of a potential lack of control and awareness of the exact occupancy leading to potential problems in the event of a claim. The tenants are not under an agreement directly with the landlord and may not have been vetted.

Landlord insurance typically covers as standard:

- 1. Property owners’ liability cover

- 2. Buildings insurance

- 3. Loss of rent cover

- 4. Contents insurance

Optional covers include:

- 5. Accidental damage cover

- 6. Legal cover

- 7. Emergency assistance cover

Property owners’ liability cover

This is often the most misunderstood or overlooked by new landlords. Liability insurance for landlords is a type of public liability insurance that compensates loss, damage, or injury to a third party and their property. The landlord is ultimately liable because it’s their responsibility to oversee that their property is adequately maintained and in a safe condition.

For example: A third party (e.g. a postman) trips on a loose slab in your drive way. You could be held liable in a compensation case.

How much should my property owners’ liability (POL) be?

Limits usually are offered at £1m, £2m or £5m. It's difficult to foresee the potential size of a claim, but consideration should take into account the number of individual occupants within the property, as this impacts the potential aggregation of personal injury claims in the event of a serious accident. In general terms the higher limits of indemnity should be considered.

Buildings insurance

You must insure your property for the rebuilding cost at today’s prices; this is one of the most important factors in protecting your property and vital you get it right. It exists to cover the costs for repairing damage right through to rebuilding - should it be needed. Imagine a fire sweeps the building out or a severe storm hits, leaving the property utterly inhabitable.

You should insure yourself for the full re-build cost of your property. Being under insured (meaning you state to your policy provider that the cost to rebuild your house is less than it actually is) will leave you vulnerable to paying the difference– as per the condition of average clause looked at below. Trying to save a few pounds on your insurance could effectively make it not worth while having in the first place.

Tip: There are various free re-build calculators online that can easily assist you in working out your re-build cost, such as the BCIS Public Rebuild Calculator.

Loss of rent: indemnity period

Should the property become uninhabitable as a result of damage by an insured peril, the indemnity period is the maximum length of time ‘loss of rent’ can be claimed for after a loss.

How long should my indemnity period be?

12 months is the standard minimum on most policies. However, longer periods should be considered, taking account of the time taken to rebuild the property. Factors to consider are location, specialist design, construction period and for older properties if it’s a graded historical building. Don’t underestimate the time it takes for demolition and debris clearance, architects, planning and then rebuilding. As you can imagine, unforeseen delays can and do occur. Also check in your Tenancy Agreement as that may also specify a longer period, perhaps 24 or 36 months or even longer.

What does landlord contents insurance cover?

A great way to understand the difference between your ‘contents’ and your ‘building’ would be to (hypothetically) tip your house the wrong way up. Anything that would fall is considered contents. This would mean furniture and decorations are covered by contents insurance, but the walls, ceiling, sanitary ware and fitted kitchen / bedroom cabinets come under buildings insurance.

When renting a furnished property this becomes important and many policies offer a standard coverage. Make sure you know what this level is and decide if you need to increase the amount to reflect replacement as new prices.

Are my tenants responsible for their own contents insurance?

Yes, they are. You are not responsible for accidental damage to your tenant’s belongings. You can advise them to acquire their own tenant’s contents or student contents insurance policy.

Subsidence insurance

If your property has suffered from subsidence – the downward movement of the structure or the ground supporting it - you will need to declare this during a quotation. It is vital that you do so, or you risk further complications caused by subsidence remaining uninsured.

You will need to provide proof that the issue has been checked by a professional and although it will most likely raise your premium, a specialist insurer should not have a problem sourcing you a policy that provides adequate cover based on a case-by-case consideration.

Accidental damage cover

This is not always offered as standard, so be sure to make clear during your quote that you want accidental damage coverage included.

Accidental damage is considered damage to the property not classed under another insurable peril. Examples include:

- Foot through the loft.

- Nail through pipe.

This is specifically to cover accidental damage caused by you. Accidental damage when caused by you tenant is usually covered by their deposit or even potentially their own insurance. Please refer to our tenant damage section for more details.

Legal cover

This is help with legal fees when taking someone to court for non-payment or equally when defending someone taking the landlord to court. Legal cover is not usually found as a standard policy feature but can be requested as an optional add-on to your policy. As a landlord you will have specialist requirements and you should speak to an advisor to discuss the costs and level of coverage you might be interested in.

Tenant damage cover

Tenants are considered to be on your property with your permission, which is why this type of cover is not a standard requirement. If an incident arose where tenants were to accidentally damage or intentionally cause malicious damage beyond the value of their deposit, this option would keep you covered for the costs.

If an incident arose where tenants were to intentionally cause malicious damage beyond the value of their deposit, this option will keep you covered for the costs.

Emergency assistance cover

Emergency assistance cover for landlords is an extra level of cover that some insurers provide as an additional cover on landlord insurance. Typically, policies include a combination of the following elements:

Boiler cover

A boiler break down can be a great cause of frustration and even cause health risks for tenants, especially in winter. Making sure you have your boiler covered with a quick incident response time means you can rest easy should something go wrong. The sudden failure or breakdown of your boiler is not included as standard on landlord insurance policies. Usually, you would arrange supplementary cover through a third party like British Gas.

Plumbing and drainage cover

Sudden damage to the home’s plumbing and drainage system caused by breakage or blockage and flooding. Drainage issues often arise in the autumn, as levels of rain increase and fallen leaves block up the gutters. If left untreated, water damages produced by plumbing and drainage issues can result in other issues such as mould.

Home security cover

If its windows or doors become damaged the house becomes insecure, which could result in theft or environmental damage to your property. Making sure that a broken door or window is replaced swiftly mitigates that risk, helping your tenants to sleep soundly.

Power cover

Should there be problems with domestic power outage, leaving your tenants literally in the dark, this element of your emergency cover will get an electrician sent out within 24 hours, making the sure the problem is solved swiftly.

Lost keys cover

If the only set of keys to the home are lost or stolen, preventing access, then lost key coverage can save the day by providing access to the property. These things happen!

Vermin cover

Sometimes the critters try to get the best of us. With vermin cover, you can make sure an infestation is dealt with swiftly and professionally, protecting your property and the wellbeing of your tenants. This covers mice, rats, wasps, and hornets. This is generally excluded from standard landlord insurance policies.

Roof cover

Another risk, especially during the blusterier seasons, is damage to the roof of your property. If something does happen which has or is likely to cause internal damage than the roofing feature of emergency assistance will have you covered.

To learn more about emergency assistance and other optional landlord insurance covers, request the policy documents and discuss with an advisor to find the right cover for you.

Landlord insurance for unoccupied property

Unoccupied properties are much more susceptible to break-ins, petty crime, squatting etc. As such, insurers generally exclude unoccupied properties from their policies as standard. If the property becomes temporarily unoccupied during a changeover of tenants or a renovation, many policies will maintain full cover for a certain amount of time, usually around 30 days. After this time period some of the cover will automatically be restricted and you’ll be asked to switch off mains services, drain water /heating systems and make regular recorded inspections.

You should always inform your insurers of any unoccupancy and check your policy to fully understand how your cover is affected. In some instances of long term unoccupancy specialist unoccupied property insurance may need to be arranged.

Understand limitations of accidental damage

It is always advised you make yourself aware of the accidental damage exclusions of any policy you consider. Typically these will exclude claims that are ‘inevitable’ such as wear, tear and deterioration. Discussing these and other exclusions will help you understand your side of the insurance agreement, such as expected levels of maintenance (plumbing, tree surgery), and what in turn you can expect your insurer to cover.

Landlord insurance for multiple properties

You will often be able to get a discount for insuring multiple properties on one portfolio. Premiums can get lower with some insurers and large discounts on admin fees. You can add newly purchased properties pro rata to existing policies allowing the policies on all properties to finish and renew at the same time. You'll need to speak with a specialist insurance provider, but they'll often be able to find you a great deal by comparing quotes from a number of insurers.

Money back

As with many commercial policies, you may not have a cooling off period affording free cancellation once your policy has been purchased. Check this during the quotation to make sure you are fully aware of what your options are.

Rent guarantees

Landlord rent guarantees are not part of landlord insurance policies but something offered by agencies to cover you if your tenant doesn’t pay. This is different to loss of rent cover, which can only be claimed when an insured peril, like a fire, has caused damage that prevents your tenant from inhabiting the property.

Renting to DSS tenants

If you choose to rent to DSS tenants, it’s worth taking some precautionary steps to avoid any issues around rent payment. Here’s a few tips:

- 1. Ask how they will pay you rent: cash, credit, direct debit.

- 2. Ask how much of their rent is covered by the financial support they receive, and what’s the shortfall?

- 3. Ask how they intend to cover the shortfall.

- 4. Consider & discuss whether weekly rent payments, rather than monthly, is more suitable.

- 5. As with all prospective tenants, make sure you check their rental history.

- 6. Declare the tenant to the local council, so council tax bills are made out to them.

Tenant referencing

Landlords are wise to properly vet their tenants to confirm their financial status and references. It makes good business sense to know who you are signing agreements with. This is a quick and relatively in-expensive service that can even be done online. We have a partner service we recommend here. Alternatively, some independent landlords prefer to do this themselves.

Subletting and landlord insurance

With the rise of the sharing economy in the shape of companies like Airbnb, subletting has become ever more popular. It’s important to speak to your tenants about subletting from the start of their tenancy so they understand the impact it may have – both on your landlord insurance and on your mortgage. Speak to an advisor if you want to discuss your options when it comes to extending your landlord insurance to cover subletting.

There has been growth in the buy to let market since it began back in 1996 and with the current monetary policy favouring buy to let investors this growth is predicted to continue. Buy to let insurance is a type of landlord’s insurance, designed to protect landlords against the risks associated with letting a property.

So how is buy to let house insurance different to regular home insurance?

When renting a property to a third party you will always need a different a kind of cover to that of a standard home insurance policy.

Though the building itself is covered on both types of insurance policy, additional aspects such as loss of rent cover can be applied; these give you more financial security if something were to go wrong. All in all, the cover is designed to protect both your material assets and your investment.

Types of tenant

When you let a property, you will always hope for tenants who are responsible and take will care of the building as you would. Tenants however, come in many different forms and some may seem more risky than others.

We recommend a vetting process as a means of ensuring your tenants are suitable for the property, it’s certainly worthwhile for your peace of mind. Below are some of the types of tenant you might come across:

- Professional Let – A working tenant or tenants, this can be an individual, a couple, a group of young professionals or a family. The main factor is they earn a living and therefore pay the rent themselves.

- Students – Less rental properties are likely to accept students but they are appealing as you can often have more people per property paying rent. Students are often associated with a higher risk but also a higher reward.

- DSS – DSS stands for Department of Social Security also known as LHA or Local Housing Authority. It is used to describe tenants whose rent is paid for through housing benefits from the local council. Again, these tenants will find fewer rental properties which accept them.

- Sub-Letting – This is rarely an acceptable risk for insurers as the proper vetting process is often not adhered to. As you have no control over who is accepted into the property it’s worth thinking hard before allowing sub-letting at your property.

- Family lets – It’s important to have a tenancy agreement in place even if you are letting to family especially if you are charging rent. Some insurers may accept cover without a tenancy agreement if letting to families and no rent is charged.

Towergate’s buy to let property insurance can cater for all the tenants listed above, and if you have any questions, just ask one of the team.

Here are the main features of cover to look out for on a buy to let insurance policy:

What’s important to remember is that you are insuring for the rebuild value of the property, not the purchase price. The ABI rebuild calculator helps with working out this cost.

-

Property owner’s liability - This is one of the most important things you can insure as a buy to let landlord. It’s your responsibility to ensure the maintenance of your property. If a third party, or their property, is subject to loss, damage or injury following an accident on, or linked to, your premises, you may legally be required to pay compensation. If this is the case, buy for let insurance can cover these expenses.

-

Buildings insurance - The trickiest part of insuring your building is calculating the right figure to insure it for. If you overestimate you will pay a higher premium unnecessarily, but if you underestimate your insurer may not be able to meet the full cost of repair. What’s important to remember is that you are insuring for the rebuild value of the property, not the purchase price. Nowadays there are some helpful calculators online for working out your rebuild cost, we’d suggest the ABI rebuild calculator as a good place to start.

-

Alternative accommodation - This cover applies if an insured peril, such as a fire, prevents your tenant from inhabiting the property. Part of your responsibility as a landlord is to provide alternative accommodation for the time where the building is not liveable. The insurance will therefore cover the cost of this accommodation while repairs are carried out. There is usually an upper limit on claims of this nature, with Towergate it is 20% of your total sum insured.

-

Loss of rent - This cover is also applied when an insured peril causes the building to be inhabitable. As your tenant cannot be expected to pay their rent during a period where the building cannot be lived in, the cover allows reimbursement of up to 20% of your sum insured in rental income you would have received. Most insurers will provide a similar cover.

See our range of other covers for landlords

Landlord insurance articles and guides

A Landlord’s Guide to Paying Tax on Rental Income

This guide explains how to calculate your rental income and how to declare it to HMRC, with some helpful tax advice for landlords.

Read moreCharacter Reference Template for Landlords

As a landlord, you may sometimes have to provide past tenants with character references. Download our template letter and tips on what to write.

Read moreCosts of Being a Landlord

Whilst letting property can be a great way to make money there are still many costs associated with being a landlord.

Read moreLandlord Responsibilities

What responsibilities does a landlord have? Understand your duties as a landlord from health and safety to legal requirements.

Read more