The most common threats faced by UK small businesses

We asked small business owners how vulnerable they feel their business is to threats in 2024, and 78.2% believe they are. This figure was higher in 2022, with 86.4% of SME owners feeling this way.

Have SMEs almost got used to the stakes being high in business? Due to the ever-challenging factors they’ve had to face since the pandemic – maybe. But what are the biggest threats to their business today.

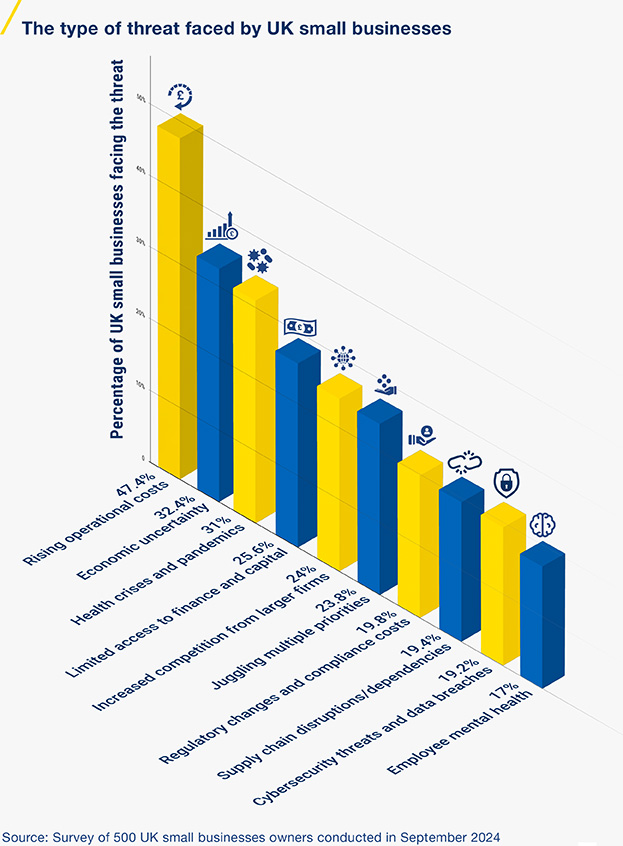

According to our recent survey, these are the most common threats to small businesses in the UK.

The most common threat to small businesses in the UK is rising operational costs (such as rent, utility bills, staff wages) with almost half the businesses surveyed (47.4%) naming this the top concern. Economic uncertainty and the impact of Brexit on trading is the second top threat (32.4%), and the third 2024 threat to SMEs are health crisis/pandemics (32%).

In contrast to the 2022 results, 2024 shows all new findings when it comes to threats to SMEs. Previously the top three threats reported were supply chain demands (32%), businesses retaining a uniqueness (27.7%), and thirdly changing customer demands (26.5%).

The top threat of rising operational costs has impacted the retail and leisure (33.8%), and healthcare (33.3%) sectors the most. And overall, 24.8% named this threat as the most departmental to their business.

This threat has transpired, but what impacts are the top threats having on UK small businesses as they become a reality too?

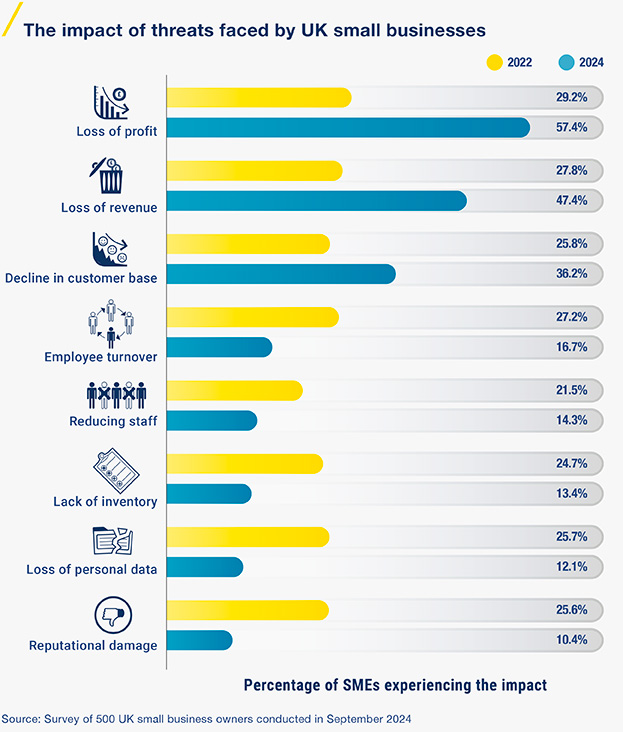

In 2024 57.3% of SMEs are experiencing a reduction in profits, 47.4% are feeling a loss of revenue, and 36.1% have a declining customer base.

The reduction in profits has increased by 96.56% since the 2022 survey where a third of small businesses in the UK (29.1%), reported this as the lead impact. Loss of revenue was a similar figure then (27.9%), and a decline in customers was felt by 1 in 4 (25.8%) of businesses.

The explosive combination of rising costs across multiple areas for businesses and their customers alike; the ripple effect of the UK’s exit from Europe, and the country’s economic standing looking to be shaky are all bearing down on these results.

When questioned about the recent change of government and the impacts on SMEs, 27.6% of owners felt the impact would be positive, while 29.6% felt it could negatively impact their business.

The sectors feeling positive change is afoot are sales, media and marketing (42.5%), our healthcare sector also felt the same way (41.6%), and IT and telecoms too (34.1%).

The not so convinced and feeling the change in government could impact them negatively is the travel and transport sector with a noticeable 50% saying this, followed by architecture, engineering and building (38.8%), and the arts and culture sector with 34.3% concerned.