Property Investment, what does the Future Hold?

Will property development and investment remain a viable option weighed up against future market trends, tax free incentives and alternative investment opportunities?

All of us have seen house prices rise enormously over our lifetimes or the lifetimes of our parents’. As a result, many of us have wondered whether developing properties or investing in a buy-to-let is the right decision for us. But in a changing economy is property investment going to stay safe as houses?

Is property development still a safe investment?

Houses... We know they cost a lot, we understand what they are made of, and we understand in general terms that they go up in value over time… for the most part. That’s a lot more than many of us can grasp about hedge funds or the FTSE 100. Couple this wariness with the horror stories about pensions losing value and dodgy bankers and it’s easy to see why so many of us look to invest in property before considering other options.

But in changing times we’ve also seen reforms to the way pensions work, tax free bank saving schemes and new forms of investment. So how does property development stand up against these, today - and what effects will future trends have on property development as a viable option to create security for our own financial futures?

The first step in the road to property investment is to ask what you’re looking to achieve. Are you looking to purchase a property to create an income over time, to redevelop and sell on, or to create some investment for retirement perhaps?

Whatever method you’re considering, you’ll likely want to maximise your investment by having the right plan in place, and that means weighing your options and making some decisions based on future predictions, such as: will house prices continue to rise? And where is the best place to invest in property?

The amount of money that a buy-to-let investor typically puts down on an investment property is currently around

£40,000

Location, location, location

A case study of success – from ‘humble’ beginnings to Property Empire

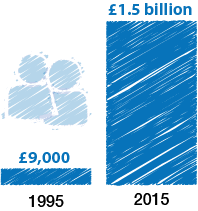

The Candy brothers, Nick and Christian Candy, started their property development business in 1995 with a £9,000 loan from their grandma. 20 years on, they are jointly worth over £1.5 billion and own a property development and interior design empire specialising in luxury homes. While property development is sometimes seen as being a lucrative endeavour, some people lost money during the 2008 recession. With the rising house prices and low interest rates of the today what opportunities and risks does the future hold for aspirational property developers and property investors?

The future of property investment

There are two main factors that would concern someone looking to invest in a property to develop: The future of the housing market and the future of the rental market. These future trends will affect how your investment will perform.

The future of the housing market

The first factor to consider is the housing market and the direction house prices are likely to go. If you’re investing in a property and counting on its capital growth, you’ll want the average price of a house to rise over time. This means that you’ll get more for it than what you paid. In this respect, for the next five years at least, most experts agree that house prices will go up.

The first factor to consider is the housing market and the direction house prices are likely to go. If you’re investing in a property and counting on its capital growth, you’ll want the average price of a house to rise over time. This means that you’ll get more for it than what you paid. In this respect, for the next five years at least, most experts agree that house prices will go up.

For many of us, it’s this capital gain that is the attraction because if you have a buy-to-let mortgage most of the rental income will probably go towards making the payments. And while interest rates are low and some profit can be made things like stamp duty, legal fees, estate agents' fees, bills while the property is unoccupied, maintenance costs and landlord insurance leave you with a paid for property in the long-term but not much monthly profit.

The future of the rental market

If you are planning to rent out the property (as opposed to developing and it selling on) your second concern is the rental market. In this day and age, people are renting for longer than they used to. Younger people are staying in education for longer, many of us are marrying later or having to save longer for a deposit to buy, higher divorce rates amongst people in later life and lifetime renters looking for quality property to live in all mean that the rental market is also set to continue to grow.

If you are planning to rent out the property (as opposed to developing and it selling on) your second concern is the rental market. In this day and age, people are renting for longer than they used to. Younger people are staying in education for longer, many of us are marrying later or having to save longer for a deposit to buy, higher divorce rates amongst people in later life and lifetime renters looking for quality property to live in all mean that the rental market is also set to continue to grow.

A market with a higher demand than supply means a strong position for the suppliers, but recent tax reforms means buy-to-let mortgage interest relief has been replaced with a 20 per cent tax credit and a 3% rise in stamp-duty for landlords. This will squeeze the profit margins for some – pass go but do not collect £200!

Where to invest in property in the UK

Some will swear by London as the best place to invest, but there are many who think the property bubble will burst. Our capital city is the most expensive place in the UK to buy a first home, let alone a second, and these exuberant prices means initial outlay is highest and rental profits are squeezed. In fact, there are many places in the UK where property prices are set to rise far more in-line with rental yields. This means that in the future, more and more investors will be looking outside of London.

Manchester

House prices rose faster in Manchester than they did in London in the first quarter of 2014. And in fact, many other places in the north of the UK are experiencing similar growth. Coupling this with higher rental yields make Manchester a very exciting opportunity to people looking to buy and develop or rent out in the future.

Many places around the UK and Scotland will see substantial rises in property prices over the next 5 years. Some are to be expected, namely anywhere within a commutable distance to London, but some are not so obvious. This list of top 10 investment hotspots highlights some interesting and sometimes surprising locations.

Changes to stamp duty

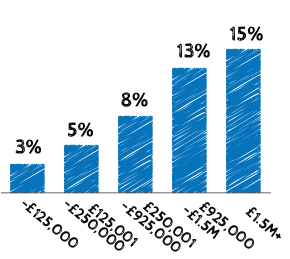

Changes to stamp duty

From April 2016 stamp duty on second properties will rise 3% for each price band. This means that some ‘buy to do up’ developers will look to purchase potential land to build on, rather than existing properties to develop.

% Stamp duty on

buy-to-let properties by property value

This is because a piece of land costing £200,000 will come with a 5% stamp duty tax of £10,000. If building a home on that land increases the value to around £400,000 and we estimate the house cost £120,000 to build, this leaves a profit of £70,000. (Excluding any other costs at this point)

Vs.

If a similar piece of land was brought with an existing property on it already, for £300,000, the stamp duty would be banded at 8% and cost a whopping £24,000. So in this case, let’s ball park the developing costs at £30,000 which leaves a potential profit (assuming you can sell the property for the same amount) of £46,000.

Initial outlay and overall costs differ in each scenario so not all options are open to everyone and of course, not all properties fit into these price brackets. However, this is certainly a method we will see from 2016 onwards as building new properties in some cases will provide much higher profits compared to developing.

Property vs. Pension

With continued growth in property and buy to let markets, many people are trusting less in pensions as a way to secure income into retirement. In fact, results from a poll of 1,500 people by The Observer show that one in three people “plan to receive retirement income from one or more buy-to-let properties”.

Pension reforms in 2014 made it possible to withdraw your pension in one lump sum - something which encountered large tax bills to do before. This means that many will now consider withdrawing and purchasing a second property instead.

One in three people “plan to receive retirement income from one or more buy-to-let properties”.

But while the overall performance of your pension is linked to how it’s respective investment performs you will undoubtable pay less in tax compared. With second and third properties, you’ll encounter capital gains tax, stamp duties, income tax and overheads but with employer contributions and the tax relief of pensions it’s possible that the pension withdrawal frenzy might settle and we’ll see more people returning to invest in this way; especially amongst higher rate tax payers who don’t want an additional taxable income.

Alternative investments of the future

Listed below are some of the more ‘alternative’ investment opportunities set for continued growth in the near future - alongside the typical investments of property and pensions. Some experts believe that the potential yields possible for these niche markets will mean more and more people will look outside the norm in the coming years.

Property

ROI 5-7%

- Time scale - Annually

- Pro - Generation rent and the housing crisis means that the right property should be easy to fill and you have the potential to earn ROI - 20-100% on your original investment if you develop and sell.

- Con - Property tax is a killer and depending on the kind of landlord you want to be you may want to pay property management fees through an agent.

- Remember - Property maintenance is not cheap.

Pension

ROI 20%

- Time scale - At least 30 years of paying NI or until you are 55 years of age.

- Pro - For private pensions your investment is doubled as your employer will match your contribution and since April 2015 you can now withdraw your pension at 55 years of age a lump sum.

- Con - You can’t withdraw the money until you’re 55 and you can only with draw 25% before you start getting taxed on the withdrawal.

Classic cars

ROI 257%

- Time scale - 8 years

- Pro - Significant increases in prices on some models.

- Con - The better condition it’s in the more money you can sell for but wouldn’t you just want to drive it everywhere?

Wine | ROI 386%

- Timescale - 13 years

- Pro - Though you will still need to invest £1000s, your initial investment is much lower than buying a house and if nothing else you can still drink it.

- Con - Like Lego you won’t receive any return on your investment until you sell.

- Remember - It’s not as easy as buying a bottle of wine and holding on to it. The way to invest in wine is through well-known merchants such as Justerini & Brooks or Berry Bros and Rudd.

*(Specifically this refers to a 2000 Mouton Rothschild Pauillac, but you see the potential)

Lego | ROI 34%

- Time scale - 5 years

- Pro - Easy to store and no maintenance, initial cost only and there’s a website to help investors.

- Con - No gains until after you have sold the Lego, unlike a rented property which is a gift that keeps on giving (if you get it right).

- Remember - Lego must be in its box and in pristine condition to be of value.