Professional Liability Insurance

Professional Liability Insurance

Key Types of Business Risk

We know that smart risk management is more than simply spotting the same old hazards and implementing the same old preventions. So being able to pin down the core risks affecting businesses right now is a great first step to building a secure model for today.

Financial Risk

Financial risk concerns cash flow - specifically whether this can measure up to a company's financial obligations. Businesses that borrow large sums of money or operate across various markets and currencies typically face this risk the most. Take a look at these resources for tips on how to keep a firm grip on your funds.

Operational Risk

Sometimes summarised as 'Human Risk', this is the threat to the company caused by a breakdown in internal procedures. This type of risk can include systems failure, employee error and even fraud, and is common in organisations which rely on frequent human interaction. Swot up on dealing with your operational risks here.

Regulatory Risk

Regulatory risk is the degree to which an organisation is open to penalty, following a change in law. Each industry will carry its own set of compliance issues, but key policies to keep an eye on concern financing, data protection and workplace health and safety. Check out these guides for up-to-date info on some important regulations.

Cyber Security

The risk of both targeted and un-targeted cyber-attacks is becoming increasingly common amongst organisations of all shapes and sizes. For any company that operates over an internet connection, bolstering cybersecurity is now more important than ever. Discover how you can up your cyber defences here.

Reputational Risk

Any threat to an organisation's good name or standing is a reputational risk. Whether directly caused by the company itself, indirectly by employees, or tangentially by partners or suppliers, a dent in reputation can have devastating effects. These guides will show you how best to present your brand in the digital age.

Physical Risk

This can be summarised as the physical danger to company buildings and property. Usually this threat comes in the form of fire or explosions, although certain industries count instances like noxious material spills as another immediate hazard. Read these articles for more advice on handling physical risks to your business.

Risk Management Plans

Every company will naturally have a very different risk profile from another. With this in mind, being able to recognise and rank the greatest threats to your particular operation is the most efficient means of prepping for the rocky road ahead.

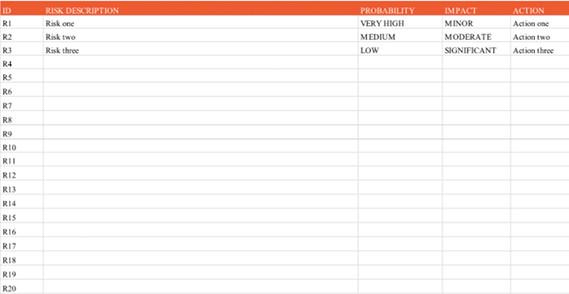

Begin by putting together a risk assessment matrix. This will allow you to outline all of your foreseeable risks, as well as the potential impact on your business. To help you get started, we've put together this risk matrix template.

Risks are rated by the likelihood that they will occur, against the risk posed if they do. Using this format will allow you to increase awareness to potential risks across your company - and plan the appropriate response.

Defining Risk

If you need help defining your business risks, then try using the acronym CASE.

Consequence

Consequence

What is the potential impact?

Asset

Asset

What is at risk?

Source

Source

Where is the threat likely to originate?

Event

Event

The incident that is expected to occur.

For example:

Employee lawsuit against the company (Consequence) due to a slip and fall (Event) caused by a wet floor (Source) resulting in a financial loss (Asset).