The Landlord's Guide To Short-Term Letting

With the rise of 'the sharing economy' propelled by start-ups like Airbnb, home owners and second home owners are in an easier position than ever to enter the short-term rental market. By putting your otherwise vacant homes up for rent, homeowners can benefit from a new source of income and present travellers with an affordable and comfortable alternative to hotels and hostels.

The demand for short-term lets is on the rise thanks to the success of sites like Airbnb, whose services make it possible to let your property at short notice and for just a few days at a time - an option that, until recently, most landlords did not consider cost-effective.

Is short-term renting right for you as a landlord?

This guide will help you make that decision, suggest ways to maximise earnings from your property, and outline the rules and regulations that you will need to comply with as you take your first steps into this potentially rewarding market.

What is a short-term rental?

First, let's try to decide what we mean by 'short-term rental'. Leading independent property adviser Knight Frank defines a short let as 'any residential tenancy of less than six months where utilities, television and internet are included in the rent.' Properties are let fully furnished and landlords are expected to provide bed linen and a fully equipped kitchen with pots and pans, china, glassware and cutlery.

That's the traditional definition, and in practice most short-term rentals have until recently been measured in months or weeks, rather than days. Airbnb and similar operations have changed the game by making it much more feasible to find tenants, even at short notice, for much shorter periods of time.

Arguably, such ventures allow homeowners who are considering letting their property more frequently to take 'baby steps' into this potentially exciting, lucrative and challenging market.

For some property owners, especially buy-to-let landlords who need to turn a business-like profit, a six-month rental may still be the right choice, as it provides a guaranteed income without the need to find a series of tenants and deal with the headaches and hassles that can entail.

Second Home Ownership

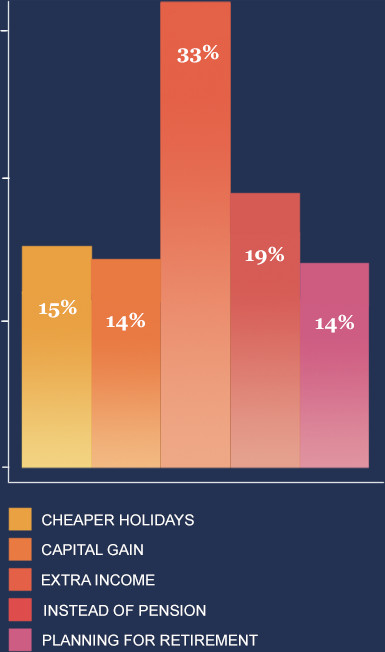

It was reported that there are over 1.7 million second homes in the UK. A 2010 report discovered that the top reason was to bring in extra income. It was also revealed that a percentage of landlords chose to purchase their second home in a location that they could holiday for cheaper, or choose as a future potential retirement destination.

It's no surprise that Cornwall is the most popular location in the UK for a second home. In 2011 just under 23,000 people, with their primary address elsewhere in England and Wales, had another home there which they used for a minimum of a month each year.

What are the top reasons for choosing to purchase a second home?

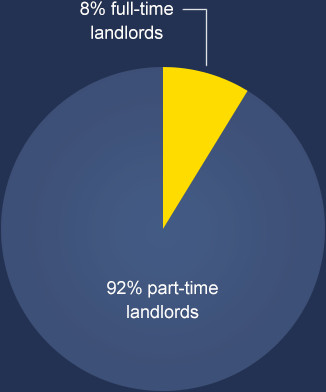

In a separate UK government study from 2010, it was found that less than 10% of private landlords rented a property full time, with 92% classing themselves as part-time landlords. These part-time landlords surveyed for the study earned around 25% of their income from rent, in comparison to full-time landlords who earned 50% or more from renting out their properties.

What different types of short term rental are there?

Buy-to-let

You may be considering buying a property to rent as a holiday let. And you'd be wise to, because the popularity of the staycation brought about by the pandemic is continuing. Verdant Leisure reports that 91% of UK adults intend to book a staycation in 2024 as the cost-of-living crisis continues to impact finances, compared to 84% in 2023.

It's important to do your homework when selecting the area in which you purchase. Holiday Lettings recommends investing in an area that is popular but where demand exceeds supply.

That way, your buy-to-let house, cottage or flat may be easier to rent and attract higher rentals. However, your investment will also be greater.

Parts of the UK, such as coast and countryside, can be highly seasonal markets: city destinations such as London or Edinburgh do experience peaks and troughs, but demand for city apartments generally fluctuates less than demand for rural properties in destinations such as Wales or the Scottish Highlands.

Letting your home

Renting out your own home temporarily doesn't require such a major capital investment as buying to let. There's a new breed of web sites that allow you to market your property, take bookings and collect payment via the internet and this has made it a more attractive, stress-free and flexible option, encouraging many home owners to venture into short-term letting.

If you live in London, where accommodation is always in demand, letting your home while you go on holiday can not only cover your fixed costs (such as mortgage repayments and utility bills), but also bring you a significant profit. However, there are still costs to consider. You will almost certainly need to invest in a specialist insurance policy to cover you against accidental damage, liability, home care emergency and possible loss of income due to unforeseeable events. You will also need to make sure that your home complies with national and local health and safety regulations.

Holiday let rules & regulations

Short let property management is a skilled practice as short let tenants are renting for a much reduced period and their expectations are high,” notes Knight Frank. “Any issues must be attended to on the same day, ideally within hours.

If you plan to rent your home out for short periods of time you may have to take local rules into account. In London, for example, homeowners were until recently banned from letting out their property for less than three months without explicit planning permission. However, the Deregulation Act, which became law in March 2015, has changed the rules to allow homeowners to let their property for up to 90 days a year.

The property in question must be liable for council tax. That said, the new Act also allows local councils to make a case for less flexibility and to exempt individual properties from the Deregulation Act if homeowners break the rules - so it's important to make sure that you know how they are being applied in your area.

So what's the difference between a short-term let and a standard, 'long-term' let?

If you're letting a property on a long-term basis, you'll be responsible for ensuring that your tenants set up their own accounts with utility and telecoms suppliers. Tenants will also be responsible for paying their community charge (council tax) and TV licences, and as landlord you may be held responsible if they don't do so.

If you let a property for less than six month however, you'll be responsible for the bills mentioned above, so you'll need to do your sums and build these into the rent you charge.

Airbnb - a new age in holiday letting

Airbnb claims to offer a service that grants opportunities to travel in a new way. It has been a game-changer, creating a 'trusted community marketplace' through which renters and landlords can connect online.

It claims to offer world-class customer service and, through its community of users, to have become the easiest way for people to monetise their extra space and showcase it to an audience of millions.

Getting the most out of Airbnb

Airbnb's business model is innovative yet simple. There's no charge for listing your property on the site, which allows you to specify exactly what type of accommodation you're offering, and the dates on which it's available. The company makes its money by charging fees to both guests and hosts on each rental.

Similarly to the taxi provider Uber, the 'trusted community' model encourages both guests and hosts to publicly rate each other's experiences. There are some steps you can take to increase your chances of successful and frequent bookings:

- Be specific - provide lots of clear photos and location information to make your property as attractive as possible.

- Get good reviews - offer a good service, be transparent, maintain the property and be on hand to solve any problems. This will help you to get good reviews and be more attractive to future tenants.

- Be active online - make sure you respond to any booking requests quickly and efficiently to put confidence in your potential tenant.

Airbnb advises hosts to secure treasured possessions when accepting guests, but the company reports very few cases of breakage or property damage. And, by providing its own guarantee to landlords, Airbnb does away with the need to ask guests for a deposit against damages - a charge that is often perceived by potential clients as an unwelcome extra.

Rival holiday letting sites

Predictably, Airbnb's runaway success has stimulated competition among other 'peer to peer' enterprises to offer similar services. Virtually all use a broadly similar business model, seeking to link a 'community' of home-owners and guests, offering free listings to home owners, and making their money by taking a percentage of the rental.

With all of these new digitally-based channels, trust and communication between landlord and guest is key. All rental sites make it possible for unsatisfied clients to vent grievances (real or imaginary) during or after their stay.

If you're thinking about venturing into the short-term or holiday rental market, meticulous attention to detail and a professional approach are essential. If you are attracted by the potential that the new short-term rental model opens up for you as a host landlord there are issues that you need to bear in mind.

- Vrbo.com can cover second-home owners looking to offset the costs of owning a holiday property, and is also useful if you have a property in a UK city that is popular with US visitors, such as London or Edinburgh.

- Wimdu.com and 9flats.com, based in Berlin, list London as its top city destination and concentrate primarily on holiday stays in key European city destinations.

- HolidayLettings.co.uk claim to offer very wide access to worldwide markets. Like Airbnb, it charges landlords 3% of the rental.

What do I need to know?

Health and safety

If you're looking to rent in the short term, it's tempting to assume that what's good enough for you as the homeowner is good enough for your guests. In terms of health and safety, that isn't necessarily so.

It's essential to make sure that:

- Your property is fully compliant with all local health and safety regulations.

- You contact your gas and electricity suppliers for an up-to-date safety inspection and address any issues that the inspector may raise.

- You carry out a fire risk assessment on your property, as required by law.

- You improve any fire safety measures (for example, by installing smoke alarm and sprinkler systems and providing fire extinguishers) and keep all your fire risks and safety measures under review.

Failure to comply with these fire safety laws will almost certainly invalidate any landlord insurance cover you may have, so investing in the services of a certified fire safety professional to review your property is well worth considering.

Tax and insurance

In terms of your relationship with HMRC, the same common-sense rules apply as to any other business.

You should make sure that:

- You seek advice from a specialist insurance provider.

- You have an accountant in place who can advise you on your tax liabilities and on what expenses - including mortgage costs - you can claim against tax.

- You know the income received through renting will be taxable like any other earnings.

- You should be able to offset the cost of specialist landlord insurance against earnings as a necessary expense, and you should also be able to offset a proportion of expenses such as water, electricity and gas bills.

- You do your homework on policy options as no two properties are alike.

Clearly, if you're letting your primary home, you may want a level of cover that is quite different from someone renting a second home or a buy to let property. For example, to cater for the worst case scenarios, you'll want cover that gives you somewhere else to stay if an accident or an irresponsible guest leaves your home temporarily uninhabitable.

Insurance for Airbnb

Insurance is a major consideration. Airbnb's own guarantee covers hosts for up to $3 million in damages which occur during an 'eligible' booking. But it is not a catch-all safety net.

As always with any kind of insurance, it's important to read the small print. Airbnb emphasises that its guarantee is not an alternative to your existing home and contents insurance policy.

In fact, your off-the-shelf policy is unlikely to give you the cover that you need as a short-let landlord, and your insurer may well exclude a claim if they find that you are letting your property.

Airbnb suggests that would-be short term landlords need to:

- Look at issues such as loss of booking income, which allows you to claim back some of the rent you'd lose if an insured event - such as a fire or a burst pipe - makes your property unavailable for a while. There's usually a limit on how much you can claim, but if you rely on the income from your property this is an important factor to consider.

- Look into purchasing liability insurance. If a guest is injured, or if their property is damaged while staying in your home, you may be considered liable. Liability insurance is designed to cover this so that you won't be left out of pocket.

Similarly, your standard home insurance policy may not cover damage to the external structure of your building if you are letting out a room or the whole property. As a more effective solution that takes all these factors into account, Airbnb often suggests that its customers consider a specialist policy which caters specifically for varying circumstances around letting. Different levels of cover are available, so you can choose basic cover for perils like fire, storm, flood and theft, or include risks liked accidental damage. No single policy can cover all the different types of property on the rental market, so it's important to be clear about how you are using the property to ensure that you have the correct cover in place.

Taking the plunge

Tempted to become a short-let landlord, but apprehensive? Professional assistance is at hand to help you take the plunge. Whether you go down the route of using an 'old school' agent such as Knight Frank or Foxtons, or use sites and services like Airbnb, you can expect your agent to take you point-by-point through the process of listing your property. They should flag up any issues that may limit the desirability of your property.

With online agencies such as Airbnb, the 'community' model may help you to identify the best markets for you in terms of the kind of guests you can hope to attract, how much they'll pay, where they are coming from and what they expect from you. But it's wise to be aware of the pros and cons for both using the services of an online letting site, and those of a high street letting agency.

Pros and Cons

Highstreet Agency

Pros:

- Letting agents can offer legal, tax and insurance advice as they should be up to date on this information

- Letting agents have experience in how to deal with dispute resolution

- Letting agents can deal with the day-to-day property management and maintenance issues

Cons:

- Letting agents will be more expensive, with the average fee anywhere between 5% and 15%

- Any extra work, such as removing a trouble tenant, will most likely be charged on top of the agreed fee

- The landlord will have less control on how the property is marketed

Online Letting Service

Pros:

- Host has full control on how the property is advertised and can vet the potential tenants

- Airbnb offers property damage protection for up to $1,000,000

- Rental transaction fee for the landlord is low at only 3%

Cons:

- Landlords must organise insurance and any legal requirements without help from the service

- There are risks with using a share-economy system, and user rated platforms - you open yourself up to potentially receive negative comments

Letting agents can offer legal, tax and insurance advice as they should be up to date on this information

Letting agents have experience in how to deal with dispute resolution

Letting agents can deal with the day-to-day property management and maintenance issues

Host has full control on how the property is advertised and can vet the potential tenants

Airbnb offers property damage protection for up to $1,000,000

Rental transaction fee for the landlord is low at only 3%

Letting agents will be more expensive, with the average fee anywhere between 5% and 15%

Any extra work, such as removing a trouble tenant, will most likely be charged on top of the agreed fee

The landlord will have less control on how the property is marketed

Landlords must organise insurance and any legal requirements without help from the service

There are risks with using a share-economy system, and user rated platforms - you open yourself up to potentially receive negative comments

Just as no-frills airlines revolutionised air travel, so enterprises like Airbnb are revolutionising the short-term rental sector. In theory, it's never been easier to rent your property for anything from a weekend to a week or a month. But if you're tempted by this potentially lucrative business, there are certain things to bear in mind.

Adequate insurance to cover you against damage, accidents, liability and loss of earnings is essential. Take out a policy that is designed specifically for your property.

Keep accurate accounts of income and expenditure for tax purposes and declare all earnings from your property when filing your annual return to HMRC.

If you're planning to buy to let, choose a location where there is strong, year-round demand for short-term rentals.

Make sure your property complies with health and safety regulations before you put it on the market.

In practice, would-be short-term landlords need to stick to old-style guidelines: do your homework, make sure you play by the rules - and above all, make sure that you take out a specialist holiday home insurance policy that covers you for a multitude of risks.