What is most likely to damage a rental property?

Aside from expected wear and tear, there are a few main reasons why a property can become damaged and need repairing.

When looking at the average cost of repairing damage since our last 2022 survey, this has increased by a massive 121% from £473 in 2022, to £1043 in 2024.

What is the costliest cause of damage?

According to our 2024 survey, theft damage is the most expensive cause of damage to rental properties and landlords spent an average of £1,128 a year fixing post break-in related repairs. Theft damage is also one of the most time-consuming tasks, with landlords reporting 2 to 4 days’ time spent on making repairs.

Southampton is reported as the worst affected area by theft damage, spending £1875.50 a year on repairs, followed by Leeds at £1477 and Liverpool third at £ 1445.82.

The second most expensive issue for landlords to fix in the UK is fire damage, and in third place is damage caused to properties from heatwave damage.

Average cost of damages in rental properties

With multiple causes of damage that may need repairing during a rental period, there can sometimes be ambiguity around who is responsible for fixing any property damage.

In fact, well over half (59.80%) of UK landlords have had a dispute with a tenant over who is responsible for property repairs or replacements.

This is a noticeable rise from 2022 where 48.5% of UK landlords were in dispute - possibly to due to the current economic climate in the UK, and the cost-of-living crisis.

Unfortunately, while damage may be caused by a tenant, landlords are usually responsible for handling any repairs, meaning that the majority of the costs also fall on the landlord. Paying for professional repairs can be a big financial blow, especially without landlord insurance.

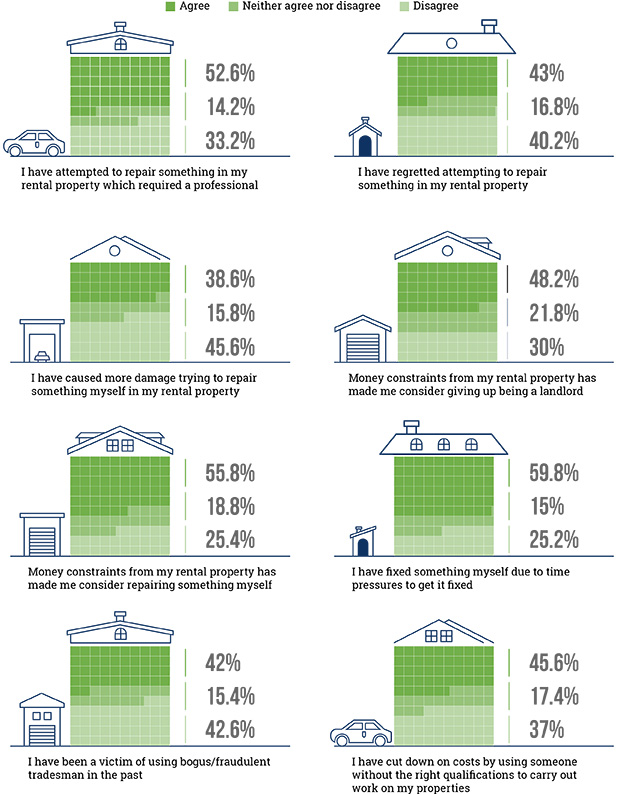

To try and get around these costs, many UK landlords turn to DIY methods to fix property damage. However, things don’t always go to plan…