Boat Insurance

Protecting your passion for boating whether you enjoy relaxing in the marina or prefer to venture further afield for your boating adventures.

- Cover for a wide variety of craft types to suit your boating lifestyle

- Dedicated advisors, who specialise in boat insurance

- Get a £40 Amazon voucher when you buy a new policy over £250*

*Terms & Conditions - £40 Amazon Voucher offer

*A £40 Amazon voucher is available to new customers who purchase a boat insurance policy online where no code is needed or over the phone and quote the code AMAZON40. This offer is subject to an annual price of £250 (including insurance premium tax at 12% and our customer service charge) or above and cannot be used in conjunction with any other offers or discounts. In addition, it is not available on the Towergate Active product for small craft where the annual price paid is under £250. Cover is subject to your individual circumstances and our eligibility criteria. The voucher will be issued to you by email after 30 days on cover. If you cancel before you have been on cover for 30 days, you will not be eligible for the offer. Offer expires on 31/12/2025 but can be withdrawn or amended at any time if it is necessary to do so. Policies purchased after this date will not be eligible for the offer. There is no cash alternative available, and we reserve the right to substitute a reasonably equivalent alternative, of equal value, should circumstances make this necessary.

Our key boat insurance polices

We also insure

Why choose boat insurance with Towergate?

Tailored boat insurance

Our boat cover can be tailored to suit your needs, depending on the type of craft you have and what you will be using it for.

Accidental damage cover for boats

Accidental damage is available for all craft types across our boat insurance policies to protect you from bumps and scrapes– a policy excess applies, varied according to the type of vessel.

No claims discount to recognise careful boat ownership.

5% discount per year up to 25% discount for five years.

£5m liability cover

£5m liability cover included as standard, to meet minimum marine requirements for accidents caused to third-parties; excluding employees and marine trade workers you employ; fare paying passengers, water skiers, parascenders and divers.

About boat insurance

Boat insurance for a wide variety of craft, covering a wide range of risks, with flexible levels of protection to suit you.

Boat contents cover for a life on the water

Boat insurance contents cover truly protects what you need for a life on the water. It includes cover for a wide range of items, and the option to extend your policy to include personal possessions cover. Please note that you must specify items that are over the policy single article limit of £300 for personal belongings for non-liveaboard or £750 on personal belongings for liveaboard circumstances. Otherwise, contents items over a single article value exceeding £2,500 need to be specified.

Cover for misfuelling and loss of berthing fees

Towergate’s boat insurance can offer up to £2000 per year cover for misfuelling (£500 limit for any one claim), as well as up to £5,000 for loss of berthing fees if you are unable to use your berth due to an insured event.

24-hour single-handed use

Cover for up to 24 continuous hours of use for avid UK sailors.

Tender insurance up to £2000

Cover for up to 24 continuous hours of use for avid UK sailors.

Optional boat breakdown cover

Through River Canal Rescue we can offer boat breakdown cover as an optional additional cover.

When you need to make a claim, we'll guide you through the process and get your claim settled as quickly as possible.

- Find your insurance documents and make sure you have all your information at hand, including your policy number.

- Call the claims team on 0330 018 2292 and explain exactly what happened

- Provide photos if requested to help us understand what happened as quickly as we can.

Boat insurance FAQs

Our boat insurance policies take into account a number of factors including the size, value and use of your craft.

Boat insurance is designed to protect your vessel, other craft and those on your boat. This can include cover against financial loss in the form of damage to your boat, a third-party claim against you from another boat owner for damage caused to their craft, or in the worst case, injury or fatality to you or one of your passengers.

Levels of cover that can be added include wide-ranging cover and third-party liability. Wide-ranging cover protects your boat if it suffers fire, theft, vandalism or accidental damage, while third-party liability provides financial protection if you have an accident involving another vessel. It compensates for any damage or injury incurred by that third party.

Our boat cover can be tailored to suit your needs, depending on the type of craft you have and what you will be using it for. Accidental damage is available across our policies to protect you from bumps and scrapes.

Boat insurance is designed to cover physical damage to equipment including the hull, sails, machinery, furnishings, on-board equipment and trailer. To ensure you purchase the policy that suits you and your boat best, verify the most expensive parts of your vessel and ensure that not only does the boat insurance policy you are taking out offer cover for damage to them, but also that you are aware of what deductions you will be faced with if you claim.

Standard boat insurance policies normally include:

-

Accidental damage, including fire, theft and malicious damage, sinking, stranding, collisions and salvage costs

-

Damage to the engines

-

Damage caused while your boat is being transported (though there may be length limits, so always check your policy)

-

Damage caused during lifting and launching

-

Damage to or loss of your boat due to latent defects

-

Damage caused by frost

-

Cover for personal items

Most policies also offer flexibility in terms of boat management, allowing anyone else to which you have granted permission to sail your boat to remain covered by your boat insurance. However, some polices do state that cover is void if your vessel is chartered, so if you are keen to do this, check whether this is acceptable.

As usual, all policies will vary, so ensure you choose the right one for your particular needs.

Although boat insurance is not a legal requirement in the UK, evidence of third party insurance is compulsory at most marinas, harbours and in recognised mooring areas. If you’re considering investing thousands of pounds in a boat, you’ll no doubt want to make sure you’ve got the right insurance cover in place to protect it.

Boat insurance isn’t a legal requirement on all waterways, but the high value of boats themselves and the potential for injury make it a risk not to have it. Additionally, many marinas require a minimum of third-party cover if you’d like to use their facilities.

If you are towing your new boat by to its mooring location by road, you should also ensure you take out your boat insurance beforehand. Any previous owners’ cover does not extend to you, and although your car insurance may cover your boat while on the journey, there are often restrictions depending on the length of your boat.

If you’re a new boat owner, it’s a good idea to seek some training. Reputable insurers like you to show you’ve reached a certain level of competence, either gained through years of experience, or following completion of a course, such as from the Royal Yachting Association.

The level of coverage you need will depends on a number of factors, particularly how and where you are intending to use your boat. Should you use your craft for more particular or competitive purposes, such as racing, you can add specialist cover to your policy for greater peace of mind and increased protection.

Our boat insurance policies cover a variety of different risks, depending on the type of craft you have, its age and size, and how and where you use it. Therefore, it’s difficult to give an average cost.

Racing – Make sure you don’t pay over the odds for localised sailboat racing. Some boat insurance policies provide cover automatically at no extra cost for localised sailboat racing such as the Round the Isle of Wight Race (including damage to masts, spars, sails and rigging). However, others may charge an additional premium, based upon the estimated cost of replacing the damaged parts. Make sure you ask before you buy – otherwise you could end up paying extra for something that’s automatically included elsewhere.

Mooring in marinas – Similarly, ask if there are any discounts for boats moored in marinas. Most insurance providers have agreements with specific marinas which could reduce your premiums by up to 20%. You can also save costs if your boat is kept ashore.

Changing mooring locations – If, after you’ve bought your policy, you change the mooring location or buy more gear/equipment, it is important to let your boat insurer know. If you don’t, it could affect any subsequent claim you make.

Boat insurance excess – Excesses will vary depending on your provider, but invariably the higher the excess, the cheaper the quote. Make sure know what you’re expected to pay out upfront if you make a claim – you may want to increase or decrease it.

Please see the page for your specific craft from the list to find more details:

Watch our video guide to the types of motor craft we can insure, to help you understand what is the right cover for you. Watch the guide here.

Watch our video guide to understand the precautions to take to ensure you stay safe when using gas on your yacht. Watch the video here.

Once it reaches 30 years of age, we will need to see a survey detailing the condition of your narrowboat. This can coincide with your BSS certification. Thereafter, you will need to provide us with a survey every five years going forward. If this is not provided to us prior to renewal, we will be unable to provide you with a renewal quotation.

Whether your dream is to own a small sea fishing boat that can carry you outside the harbour entrance for a spot of bass fishing or for a larger vessel that can take you and a party well offshore to the fishing grounds, the same principles of decision making apply there are a few questions to ask yourself to understand which is the best fishing boat for you.

Questions to ask yourself when choosing your fishing boat…

- Experience- You might have plenty of fishing expertise, but have you owned a boat before? If not, be realistic about the size and type of boat you can manage.

- Size - How far offshore do you want to go and how many passengers do you want to be able to carry?

- Type - Do you want slow, heavy, light, fast, rugged, stable?

- Skills - How are your boat handling and navigation skills? Do you have a VHF certificate?

- Budget - Do you have a budget in mind? Have you listed all the costs involved?

- Time - Owning a boat consumes plenty, how much spare time do you have available?

- New or used - What are the pros and cons?

- Engine - Are you thinking of an inboard or outboard engine?

- Storage - Will you keep the boat ashore, on a mooring or in a marina?

- Road transport - Will you need a road trailer? If so, check the maximum towing weight of your vehicle?

- Maintenance - Are you planning to maintain the boat yourself?

Size of boat

Some may argue that you can fish from any size of vessel, but in order to have an enjoyable experience any boat under 4 metres in length is going to be a challenge.

5 metres

A 5 metre is suitable for a first time boat buyer, being easily manageable. A 5 metre boat can normally be launched from a trailer fairly easily.

6 metres

Boats of 6 metres in length will require a strong vehicle with a high towing capacity, especially those with cuddies which will add to the weight. The extra metre in length will provide much more room than a 5 metre.

6+ metres

Boats over 6 metres in length will be better suited for offshore fishing and give you more freedom to explore fishing grounds further from your home port. Expect to pay much higher prices for boats this size and bigger.

Note: Fishing boats with cuddies offer more protection than an open boat but they also limit the all-round fishing experience.

Transporting your boat by road

If you plan to transport your boat by road it is important that you check your vehicle has adequate towing capacity and that the combined boat and trailer gross weight does not exceed this. For example an average family car should be able to manage a combined boat and trailer weight up to 750kg, while the largest 4x4s can tow a combined boat and braked trailer weight up to 3500kg.

Note that braked and un-braked trailers have different limits. Rules and regulations for towing in the UK and Europe are quite complex.

Hull type

There are all kinds of boats out there suitable for sea fishing, varying in shape, size and purpose. Choosing the hull type is a good way to start narrowing down your choice.

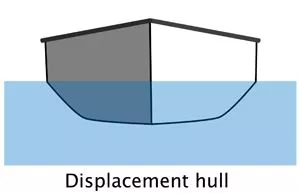

Displacement hull

Displacement hulls are used for slow, heavy vessels like trawlers and tugs. A displacement hull moves through the water by pushing the water aside and cutting through it at a slow, steady speed. Fishing boats with displacement hulls are economic on fuel and move through the water easily and efficiently. They don’t tend to rock around and are able to cope well with rough seas.

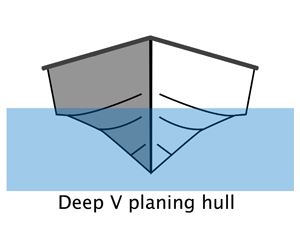

Planing hull

Planing hulls are designed to rise up and skim or ‘plane’ over the water once they have reached a high enough speed (usually 15 knots or more). They require large powerful engines to build up sufficient speed to plane. Most boats designed to plane are made of light materials to keep their weight down.

Planing hulls are V shaped in section at the bow, to help the hull cut through the water, extending to a flatter bottomed, wider shape towards the stern, allowing the boat to skim over the water at speed.

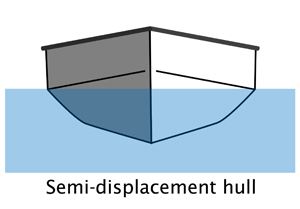

Semi-displacement hull

A semi-displacement hull is normally narrower than a planing hull, with a fine bow but a more rounded hull shape than a pure planing hull and a flat part at the stern to help create lift. The more rounded shape of the hull makes it more comfortable than a planing hull in a rough sea.

Semi-displacement hulls are well suited for rugged, sea going boats such as pilot vessels, which are able to move quickly through heavy seas.

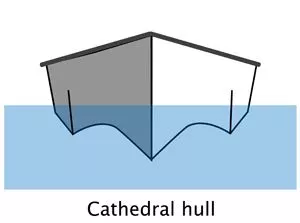

Cathedral hull

A cathedral hull is a variation of a planing hull and a popular shape for fishing boats. Cathedral hulls have a deep V shape along the centre with two smaller V shaped sections on either side, similar in design to the roofs of old cathedrals. This design gives a stable platform that is suited for fishing and copes well with rough conditions.

The hull shape also enables greater speed than a heavy displacement equivalent, which gets you to the fishing ground quicker and back home quicker if the weather turns nasty.

Budget for your fishing boat

It is a good idea to list of all the likely costs. Here are two basic checklists covering the initial purchase costs and annual expenses:

1. Boat and equipment purchase

- Purchase price - Check what equipment is included

- Trailer - If a road trailer is not included, this can be a major item

- Survey - Essential if you buy a used boat

- Spare engine - If your main engine fails, a spare outboard will get you home

- Navigation equipment - GPS, compass, VHF radio, nav lights, foghorn

- Fishing equipment - Fish finder, rod holders, tackle, rigs, buckets, storage boxes

- Safety equipment - Lifejackets, fire extinguishers, flares, lifebuoy, first aid kit

- Deck gear - Anchors, chain, warp, mooring lines, fenders

- Spares - Engine spares, fuses, light bulbs, tools

2. Annual running expenses

- Engine servicing - Get quotes from service engineers before you buy

- Trailer servicing - Brakes, bearings, corrosion protection

- Maintenance - Hull, props, antifouling, paint, varnish, safety gear

- Storage fees - Get quotes from marinas, boat yards, harbour and river moorings

- Harbour dues - If you are based in a harbour, expect to pay annual fees

- Fuel - Make an allowance for fuel, based on expected annual usage

- Repairs - Wise to factor this in, even if an unknown

- Tackle - The sky’s the limit

- Insurance - Find out more about boat insurance

Searching for the best small sea fishing boat?

A good place to start searching is by browsing a few of the many websites and forums that are dedicated to sea fishing and boat buying. Most online marketplaces enable you to refine your search to suit your requirements and some have advanced search features which will notify you if a boat matching your search criteria comes on the market. By signing into online forums, you can easily get advice from people with experience. If you browse online you will find several for sea angling enthusiasts.

Boat shows

Visit the boat shows if you can, not only to look at the boats, but talk to the people working in the boating industry - designers, manufacturers, finance people, the training schools and more. Most will happily offer their advice at these shows and are used to doing so. There are many boat shows held around the UK during the year, the largest being London (every January) and Southampton (every September).

It is advisable to talk to a few brokers in your area as they will be able to help guide you through the boat buying process. Most are happy to offer advice and can show you round fishing boats in your price range.

Buying a used sea angler

It is advisable to decide early on whether you are going to buy new or used, as the buying process differs a little.

If you buy new, then there is much more scope to have the boat customised to suit your needs. While a new boat will cost more, it may prove easier to arrange good finance terms as repayments can be spread over longer periods.

If you buy a pre-owned boat, say a few years old, it should be a lot less than the cost when it was new and the depreciation will be less as it gets older, provided you maintain it in good condition. You will need to have the boat inspected by a surveyor but you can land yourself an excellent boat at a very good price.

New versus used boats - pros and cons

| New boat - Pros | New boat - Cons | Used boat - Pros | Used boat - Cons |

|---|---|---|---|

| Good financing options | Rapid depreciation early on | Purchase cost is less than new | Financing options not as good as for new |

| Warranty protection | Purchase cost | Usually better equipped than new | Warranty may not be included |

| Choose the specification to suit your needs | Equipment and gear will be extra | Less depreciation | Specification as seen |

Engines - inboard or outboard?

Most small to medium sized fishing boats on the market have outboard engines, many being modern 4 stroke engines, which are quieter than the older 2 stroke engines.

Opinions vary whether inboard is preferable to outboard, but it is generally accepted that outboards are best suited for small to medium sized fishing boats and inboard diesels are the engine of choice for larger boats, say over 8 metres. Inboards tend to be heavier, more expensive and more difficult to work on, but on the other hand they last far longer.

There are pros and cons for both but for the purposes of this article, let’s go with the outboard. If you find a boat with an outboard, then there are a number of things you should check:

- Contact the manufacturer and check the engine is the correct weight and horsepower rating for the boat. An overpowered engine will affect handling and balance and may also damage the transom; an underpowered engine will have to work very hard and might overheat easily.

- Check the shaft length of the outboard will be suitable for your boat’s transom.

- You need to see the engine running. Make sure that the cooling system is working properly.

- Note: If a water cooled engine is run out of the water it can do major damage, by overheating the engine and destroying the impeller. Make sure the engine has a proper water supply for the cooling system if the test is done ashore.

- If the engine is a 2 stroke check that marine grade two stroke oil has been used in the mix. It needs to be TC-W3 approved oil, which is expensive but essential for the health of a marine 2 stroke.

- Ask to see compression figures for the engine. If the readings are 10% below or more than the manufacturer’s recommended level in any of the cylinders then this indicates wear and the engine will need a rebore and new pistons, which will be expensive.

- Check the fuel consumption for the engine, measured in gallons per hour.

- Avoid buying a non-runner unless you are an experienced mechanic.

- Check the engine serial number (S/N) - this will enable you to check online the age of the engine by going to the manufacturer’s website and entering the make, horsepower and S/N.

Maintenance of your angling vessel

Salt water is a punishing environment for engines, electrics, instruments, paintwork, varnish and just about anything that is manmade. If a boat isn’t regularly maintained and looked after then the risk of engine failure or equipment failure will increase and sooner or later something is going to break and ruin your day.

When you look over a used boat, it is important to thoroughly check the vessel’s maintenance records. If records are not available, then proceed with utmost caution as replacing gear can get very expensive and time consuming.

Training

All recreational boats placed on the market after 1998 between 2.5m and 24m in length are required by European Law to comply with minimum standards set by the Recreational Craft Directive (RCD). When looking for a boat, the RCD category will be marked on the identification plate, along with the maximum recommended load, number of persons recommended, manufacturer’s name etc.

The RCD states that manufacturers have to categorise their boats into one of four categories that are rated according to the seaworthiness capabilities as follows:

Choosing a fishing boat - our summary

- The more background boating knowledge and practical skills you can build up the better.

- Choose the right type of boat to suit your needs and experience.

- Work out your budget, including running costs.

- Check out the sea angling forums - a great place for advice.

- Decide whether you want to buy new or used.

- Get a survey for a used boat. Pay particular attention to engine condition.

- Visit the boat shows.

- Talk to brokers; most will offer advice and help guide you through the process.

- Sign up for some training unless you are already a skilled boater.

It is always recommended that you check your policy documents for a comprehensive list of exclusions but typically boat insurance does not include cover for:

- Wear and tear

- Deliberate acts of negligence or recklessness

- Operating a boat under the influence of drugs or alcohol

- Individuals not wearing ‘kill-cords’ on crafts which require them, such as jet skis

Aspects that are excluded from standard boat insurance policies are:

-

Damage caused to the vessel due to deliberate misconduct

-

Damage due to wear and tear

-

Damage due to corrosion osmosis

-

Damage to machinery if your boat breaks down

Other areas to check your policy on carefully include the following.

Sailing limits – Always check your policy’s cruising range. UK policies usually only cover UK inland and coastal waters, so if you’re sailing further afield, you’ll need to extend your limits.

Seasonal cover – Some policies only provide cover for certain times and stipulate your boat should be secured ashore for the rest of the year. Check policy limitations: if you’re at sea when you should be ashore (due to bad weather or an unexpected sailing delay) you might not be covered.

Water sports – If you intend to use your craft for water sports, such as towing inflatables, check with your insurer that your policy covers this.

Trailer condition – Don’t forget to keep your trailer in good condition: if this fails, your boat may be damaged and rendered unseaworthy under your policy. Check the wheel bearings, hitch locks and breakaway cables carefully.

When you need to make a claim, we'll guide you through the process and get your claim settled as quickly as possible.

- Find your insurance documents and make sure you have all your information at hand, including your policy number.

- Call the claims team on 0330 018 2292 and explain exactly what happened

- Provide photos if requested to help us understand what happened as quickly as we can.

Boat insurance articles

07/08/2018

Do I Need a Qualification to Buy a Boat?

A commonly asked question by first-time buyers of boats is what, if any qualifications you need to buy a vessel. Read our explanation to find out.

Read more26/02/2018

Living in London: Cost of Living on a Narrowboat versus in a Flat

Thinking of getting on the property ladder? This article compares the cost of living in London on a narrowboat against a London flat.

Read more18/09/2019

Interior Design Ideas for Your Narrowboat Home

So you’ve finally taken the plunge and bought your very own narrowboat, now you’re faced with the exciting yet daunting prospect of turning it into a home.

Read more18/03/2024

The First Time Owner's Guide to Buying a Narrowboat

We've put together a guide and checklist for anyone who is thinking of taking the plunge and buying a narrowboat.

Read more24/03/2015

Gas safety on your boat

Our video looks at different types of gas we use on a boat and how to stay on the right side of safe when you do. Boat advice videos from Towergate

Read more