Motor Boat Insurance

Cover for motor boats and speed boats on and off the water.

- Be ‘marina ready’ with £5m in third-party liability and sighting costs covered

- 'Agreed value’ options for special-build motor boats.

- Get a £40 Amazon voucher when you buy a new policy over £250*

*Terms & Conditions - £40 Amazon Voucher offer

*A £40 Amazon voucher is available to new customers who purchase a boat insurance policy online where no code is needed or over the phone and quote the code AMAZON40. This offer is subject to an annual price of £250 (including insurance premium tax at 12% and our customer service charge) or above and cannot be used in conjunction with any other offers or discounts. In addition, it is not available on the Towergate Active product for small craft where the annual price paid is under £250. Cover is subject to your individual circumstances and our eligibility criteria. The voucher will be issued to you by email after 30 days on cover. If you cancel before you have been on cover for 30 days, you will not be eligible for the offer. Offer expires on 31/12/2025 but can be withdrawn or amended at any time if it is necessary to do so. Policies purchased after this date will not be eligible for the offer. There is no cash alternative available, and we reserve the right to substitute a reasonably equivalent alternative, of equal value, should circumstances make this necessary.

One of the UK's leading independent insurance brokers

Why choose motor boat insurance with Towergate?

Marina ready motor boat

With up to £5 million in third-party motor boat liability cover.

Sighting costs covered

If grounded, the reasonable costs to check for damage are included.

‘Agreed value’ motor boat cover

Option to move to ‘agreed value’ insurance for special-build motor boats.

About motor boat insurance

Third-party liability cover

Be ‘marina ready’ with £5 million in third-party motor boat liability cover. This excludes employees and marine trade workers, fare paying passengers, water skiers, parascenders and divers. Third-party liability for water skiers and towing of toys can be added as an optional extra.

Special-build motor boat insurance

Do you customise your craft to meet your specific needs, but feel uneasy as to whether or not you're adequately insured? That's why we offer an 'agreed value' cover option (as opposed to market value) for your special-build motor boats. Just be sure to check the value of your craft.

Motor boat sighting costs

We understand the need to keep your vessel and family safe if you suspect that you've grounded. You can be rest assured that our motorboat insurance policy will cover the reasonable costs of inspecting the underwater part of the hull of your boat, even if there is no damage found.

Machinery failure cover

We provide machinery failure cover for motorboats under 5 years old as standard. There is also the option to add this cover for motorboats aged between 5 and 10 years.

When you need to make a claim, we'll guide you through the process and get your claim settled as quickly as possible.

- Find your insurance documents and make sure you have all your information at hand, including your policy number.

- Call the claims team on 0330 018 2292 and explain exactly what happened.

- Provide photos if requested to help us understand what happened as quickly as we can.

Ready to get covered?

- Fill in our online quote form or call us

- Purchase your policy

- Relax - You're covered!

Motor boat insurance FAQs

Like owning a fast car, owning a motor boat has a few risks attached to it. The value of items like outboard engines for example which makes them attractive to thieves.

Additionally, their capability for high speeds means the potential for personal injury and damage to other craft is also a factor. Motor boat insurance aims to provide support by putting you back in the financial position you were in before a loss such as theft from your motor boat.

Towergate Motor Boat Insurance covers personal injury, damage to your boat and damage caused by you to other people or their property on the water.

You don’t have to have motor boat insurance by law but some marinas do require third party cover as a minimum in order for you to moor there. Regardless of where you keep your boat, it’s best to get covered.

We offer four levels of cover to help you get the insurance which fits the way you use your motor boat.

On a basic level, we offer third party cover for those with smaller, less frequently used craft. At the other end of the scale, our Platinum level policy covers a wider range of perils such as personal injury, freezing of machinery and accidental loss or damage.

- £3,000,000 third party liability included as standard - It can all be a bit unpredictable when you’re out on the water. We know you’re as careful as you can be but sometimes, accidents happen. That’s why, as well as covering your craft, we also include £3,000,000 worth of third party cover.

- Road transit cover for craft under 30ft –If you don’t like staying on one particular stretch of water, you may need to transport your motor boat by road to pastures (or rather, waters) new. Our silver level policy (and all levels above silver) includes cover for your boat and trailer while you’re on the road.

- Cover for theft – As motor boats are quite high in value, they can be targeted by thieves. Also, as outboard motors are easy to remove (and high in value themselves) on some craft this also makes motor boats easy pickings for thieves.

- Underwater machinery cover – Ever gone over a speed hump too quickly in your car and scraped the under-carriage? If you run over a submerged object in your motor boat, it can cause damage to the propeller, prop shaft or rudder. This element of our motor boat insurance covers you should this happen.

- We won't charge you your excess on any claim made while it’s moored or stored in a marina.

- Personal accident cover (optional) – If you enjoy testing the limits of your craft, we strongly recommend adding personal accident cover to your policy. Personal accident cover will pay for emergency medical expenses. It will pay out in the event of lost limbs, loss of sight and even total disablement or death.

- Continental use – If you trailer your boat abroad and use it on European waters you’ll still be covered for up to 30 days at a time.

Protected no claims bonus (platinum level cover) – Take out our highest level of cover to have your no claims bonus protected year on year even if you have to claim (No more than two claims per year). - Marina benefits (platinum level cover only) – If you permanently moor your boat on a marina berth or keep it ashore at the same location, we won’t charge you excess on any claim made while it’s moored or stored. This also won’t affect your no-claims bonus.

- Travel concierge service – Part of the joy of owning a yacht is the ability to travel to new places. What to do when you get there though? Give our travel concierge service a call and they can arrange; local hotels, restaurants, theatre tickets and more.

- Legal expenses cover –Should a third party bring charges against you for damage caused to their craft or personal injury caused by you, our legal expenses cover can help with your legal fees up to £100,000.

- 24 hour legal and claims advice line –In addition to covering legal fees, we also offer legal advice to guide you through what to do if you get involved in a legal dispute.

We offer four levels of cover to help you get the insurance which fits the way you use your motor boat.

On a basic level, we offer third party cover for those with smaller, less frequently used craft. At the other end of the scale, our Platinum level policy covers a wider range of perils such as personal injury freezing of machinery and accidental loss or damage.

Consider where you moor your motor boat –Some moorings aren’t very suitable for certain types of craft. It’s worth doing your research to find the right mooring for your craft. If your motorboat is moored on the wrong type of mooring, we may not be able to cover you.

Think about other items you may want insured –We can provide cover for hand held electronics such as GPS or VHF radio. However, you’ll need to let us know that you’d like them covered otherwise they may be over looked.

Tell us about your RYA qualifications – We like to reward people who try to develop their own sailing competence as this only makes them safer on the water. Let us know if you’ve got any RYA qualifications and we may award you another 10% discount.

Our motorboat insurance policy covers a multitude of types of craft. But motorboat is just one overarching term when in fact, we can provide a policy that’s specific to different types of motorboat.

Here are some of the different types of boats we cover, to help find the policy which is right for you.

• Sports boat – These tend to be hugely powerful (200bhp engines and above) with long but narrow hulls. Like a sports car, these boats are often two seaters with a helm which also looks similar to the inside of a sports coupe.

• Ski boats – Generally these are used for, you guessed it, water skiing and wakeboarding. The hulls of these boats are designed to create wake and are normally quite powerful in order to tow people behind them. They’re also sometimes modified to hold extra boards or skis.

• Sports cruisers – These are similar to sports boats however, they tend to be larger, able to carry more people and designed more for comfort than out and out speed.

• Fast fisher – These are set apart from your average fishing boat due mostly to their power. They normally have a large outboard motor and a central cuddy.

• River cruisers - These are sometimes called gin palaces and are essentially small, powered yachts. Think Henley, on a sunny afternoon, trundling along at a few knots with enjoying the scenery. I must stress that while Towergate can insure a number of types of motorboat, we cannot insure anything with a top speed over 55 knots.

RIB Insurance only covers RIBs. RIB stands for ridged inflatable boat. RIBs have both inflatable and solid parts to their hulls and are almost always powered by outboard engines. RIBs could be considered as the 4x4s of the sea.

They’re versatile, fast and almost unsinkable. Though they can be used as straight forward pleasure craft, RIBs are often used as safety boats by sailing clubs, excursion boats by SCUBA dive clubs and sometimes for thrill rides by tour companies and holiday resorts

It’s very important to read your policy documents in detail to understand exactly what’s covered what’s not covered and what might render your cover invalid. Here are a few exclusions you should really be aware of but be sure to read your documents to make sure you understand all of them.

• Outboards must be secured – You must use an anti-theft device in order for your theft cover to be valid.

• Third party cover is excluded whilst in transit – The good news is, third party cover whilst you’re trailering should be covered by your car insurance. It’s best to check with your car insurance provider though.

• Trailers must be secured with a wheel lock – If your boat has a top speed of 17 knots or more, you’ll need to secure the trailer with a wheel clamp when you leave it unattended for your policy to remain valid. If your craft has a top speed lower than 17 knots, a hitch lock can be used instead.

We'll cover you for wake boarding and water skiing however you can only tow two people at any one time.

• Water ski and towing toys –Water skiing and wakeboarding are popular activities among motorboat owners. We will cover you for these activities however, you may only tow a maximum of two people at a time.

• Personal accident cover won’t cover individuals over the age of 76 – If you’re over the age of 76 the personal accident aspect of our cover will not apply. All cover relating to the craft however, will still apply.

• Wear and tear - Wear and tear is not covered at all by our motorboat insurance policy.

• Replacements beyond the sums insured on your policy – This policy works on a market value basis. Therefore, it’s important to know the true replacement value of your motorboat. You will be unable to claim for a replacement motorboat above the value you give us. If you’re unsure of the value of your motorboat, a marine surveyor will be able to make an assessment and give you an accurate value.

• Racing - Unfortunately, we can't provide motorboat insurance if you race your craft as the risk of accident becomes too great.

Our motorboat and speed boat insurance policies cover a number of items, including things you’d carry on your person such as digital compasses, or pocket knives. These smaller items do have a single article limit of £300. However, you can also cover more expensive items such as onboard GPS equipment and outboard motors.

All you need to do is let us know what you’d like covered, so we can include it in your sums insured. Please let us know if you would like to cover any items over the £300 single article limit.

Yes. For example, we can’t usually cover you in the Caribbean or the Baltic seas. You’ll also need to let us know if you want to change your cruising range from what you originally agreed when you set up your motorboat or speed boat policy. See the question below for more detail.

Things never stand still in the world of boating, so if you’ve installed the latest gadget and you need your sums insured updated or you’ve changed your mooring arrangements or cruising range, give us a call and we’ll update your motor boat insurance policy.

If your GRP boat is over 35 years old, we will require sight of the survey. Furthermore, you will need your craft to be evaluated every 10 years thereafter. Wooden or steel boats need to be surveyed at 30 years old, and then every 5 years after.

Yes, we also provide liability for those actively using older motor boats on slipways or launching onto the water. It meets most requirements for inland waters, such as The Thames, Norfolk Broads, lakes, and canals. This third-party cover product includes the removal and disposal of wrecked craft, as well as the re-floating and removal of damaged craft (under 60 years old).

The short answer is; everything else where the sole method of propulsion is an engine. The long answer is: sport boats, sports cruisers and fast fishers among many others.

Both RIB and motorboat policies feature third party cover, theft, malicious damage and vandalism cover and even personal accident when you take out our highest level of cover. Both policies have platinum, gold, silver and bronze levels of cover which means you can choose the level of cover to suit your usage and requirements.

In some ways, motor boat insurance works like car insurance. If you’re an experienced driver and you keep your car in a garage at home, your premium will be lower. Similarly, if you’re an experienced boater with an RYA qualification who keeps their boat in a marina, we’ll offer you discounts on your premium. Also, let us know if you have any RYA powerboat qualifications to take advantage of further discounts.

If you are looking to buy a power boat, a bit of background knowledge is essential, especially if it is the first time you have bought a boat. Doing your homework will help you make the right decision and ensure that you get the perfect boat for you. There are a number of practical considerations you need to make to get your started, such as what you will use the boat for, how large you need the vessel to be, your budget, and whether you will be buying new or used.

When it comes to buying your power boat it is worth trying to visiting one of the boat shows in order to speak to experts and shop around: there are many held each year with the largest being London in April and Southampton in September. If you are unable to attend you should do as much research as possible by searching online and reading boating publications.

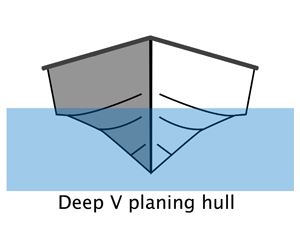

Power boat hulls

One of the most important considerations is what you are planning to use the vessel for, as this will help you to choose the right boat to suit your lifestyle. To narrow down your search it is worth looking at the basic principles of hull design.

There are three main types of hull:

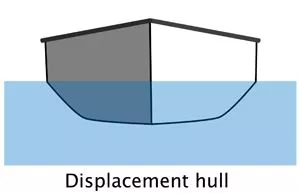

Displacement hulls

Displacement hulls are used for heavy vessels like trawlers and tugs. They are economic with fuel and are able to cope well with rough seas. However, they are very limited in the speeds they can reach and are better suited to long distance cruising.

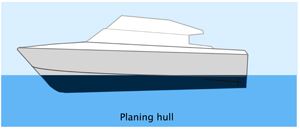

Planing hulls

Planing hulls are designed to skim over the water once they have reached enough speed. They require powerful engines and are usually made of light materials to limit the weight of the vessel. They have very high fuel consumption and maintenance costs but they are very fast and a lot of fun.

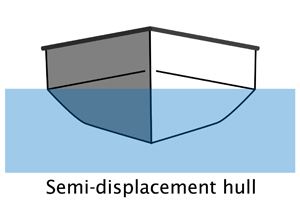

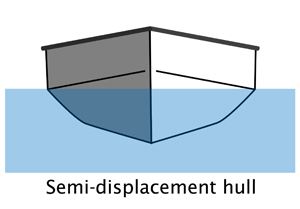

Semi-displacement hulls

Semi-displacement hulls are designed to offer the best of both worlds, with both speed and practicality. They are well suited for rugged seas but are also able to reach a reasonable speed. Semi-displacement hulls are the preferred choice of hull for many designers and boat builders.

Budget

When considering purchasing a power boat it is important that you take into account the annual running costs of running a boat such as marina fees, engine servicing, maintenance, fuel, harbour dues and power boat insurance.

| New Power Boat Pros | New Power Boat Cons | Used Power Boat Pros | Used Power Boat Cons |

|---|---|---|---|

| Good financing options | Rapid depreciation early on | Purchase cost is less than new | Financing options may not be as good |

| Warranty protection | Purchase cost | Usually much better equipped | Warranty may not be included |

| Choose the specification to suit your needs | Equipement will be extra | Less depreciation | Specification as seen |

What is the process for buying a new power boat?

If you are buying a new boat you have the option of buying direct from a manufacturer or via an authorised dealer or agent. If the manufacturer is not based in the UK then it is likely that they will have a UK agent you can contact.

You should always ensure that you receive a builder's certificate, and that the boat is built and equipped to Boat Safety Scheme standards. You should always make sure that sea trials are included as part of any contract you sign as it is important that you try the boat before you buy it.

What is the process for buying a used power boat?

When buying a used boat you can either do so using a broker or through a private sale. Whichever option you choose it is important that you go for a number of viewings and look out for things such as:

-

Indentations in the hull

-

Oil leaks

-

Damage to the propellers and rudder

-

Sign of corrosion on metal hulls

-

Signs of damp

Find out as much as you can about the boat before you make an offer, such as the history of the boat, outstanding mortgages, how long the boat has been for sale, and whether it has been in any accidents. Once you have done your visual inspection and background checks it is vital that you partake in a sea trial to see how the boat actually runs and handles.

What is the process for making the final purchase of a power boat?

Once you have narrowed down your search and found a number of power boats you are interested in you should arrange viewings and get a surveyor to inspect each vessel, including the hull. If any works are required on a boat you can either insist the work is done and paid for by the vendor or have the price reduced accordingly. If the vendor does not agree to these options you can withdraw from the sale and have your deposit returned.

How do I register my power boat?

When purchasing a power boat it is important that you declare it on the appropriate registers which record the details and ownership history of the vessel.

-

The British Register of Shipping - Private yachts and power boats bought with a marine mortgage are required to be registered by most finance companies.

-

The Small Ships Register - It is advisable but not mandatory to register a pleasure boat up to 24 metres long with the Small Ships Register. This is important if you plan to take the boat abroad as it proves the boat's nationality.

-

Safety Identification Scheme - By registering your boat with the UK coastguard your details will be available to Maritime Rescue Co-ordination Centres throughout the UK.

One of the most important considerations is what you are planning to use the vessel for, as this will help you to choose the right boat to suit your lifestyle. To narrow down your search it is worth looking at the basic principles of hull design.

There are three main types of hull:

Displacement hulls

Displacement hulls are used for heavy vessels like trawlers and tugs. They are economic with fuel and are able to cope well with rough seas. However, they are very limited in the speeds they can reach and are better suited to long distance cruising.

Planing hulls

Planing hulls are designed to skim over the water once they have reached enough speed. They require powerful engines and are usually made of light materials to limit the weight of the vessel. They have very high fuel consumption and maintenance costs but they are very fast and a lot of fun.

Semi-displacement hulls

Semi-displacement hulls are designed to offer the best of both worlds, with both speed and practicality. They are well suited for rugged seas but are also able to reach a reasonable speed. Semi-displacement hulls are the preferred choice of hull for many designers and boat builders.

When considering purchasing a power boat it is important that you take into account the annual running costs of running a boat such as marina fees, engine servicing, maintenance, fuel, harbour dues and power boat insurance.

|

New Power Boat Pros |

New Power Boat Cons |

Used Power Boat Pros |

Used Power Boat Cons |

|---|---|---|---|

|

Good financing options |

Rapid depreciation early on |

Purchase cost is less than new |

Financing options may not be as good |

|

Warranty protection |

Purchase cost |

Usually much better equipped |

Warranty may not be included |

|

Choose the specification to suit your needs |

Equipement will be extra |

Less depreciation |

Specification as seen |

If you are buying a new boat you have the option of buying direct from a manufacturer or via an authorised dealer or agent. If the manufacturer is not based in the UK then it is likely that they will have a UK agent you can contact.

You should always ensure that you receive a builder's certificate, and that the boat is built and equipped to Boat Safety Scheme standards. You should always make sure that sea trials are included as part of any contract you sign as it is important that you try the boat before you buy it.

When buying a used boat you can either do so using a broker or through a private sale. Whichever option you choose it is important that you go for a number of viewings and look out for things such as:

-

Indentations in the hull

-

Oil leaks

-

Damage to the propellers and rudder

-

Sign of corrosion on metal hulls

-

Signs of damp

Find out as much as you can about the boat before you make an offer, such as the history of the boat, outstanding mortgages, how long the boat has been for sale, and whether it has been in any accidents. Once you have done your visual inspection and background checks it is vital that you partake in a sea trial to see how the boat actually runs and handles.

Once you have narrowed down your search and found a number of power boats you are interested in you should arrange viewings and get a surveyor to inspect each vessel, including the hull. If any works are required on a boat you can either insist the work is done and paid for by the vendor or have the price reduced accordingly. If the vendor does not agree to these options you can withdraw from the sale and have your deposit returned.

When purchasing a power boat it is important that you declare it on the appropriate registers which record the details and ownership history of the vessel.

-

The British Register of Shipping - Private yachts and power boats bought with a marine mortgage are required to be registered by most finance companies.

-

The Small Ships Register - It is advisable but not mandatory to register a pleasure boat up to 24 metres long with the Small Ships Register. This is important if you plan to take the boat abroad as it proves the boat's nationality.

-

Safety Identification Scheme - By registering your boat with the UK coastguard your details will be available to Maritime Rescue Co-ordination Centres throughout the UK.

Not only do we know insurance inside out, we also know the items and lifestyles we insure inside out. All our advisers are trained to make sure you get the most appropriate cover for you and your motor boat.

Should you need to claim, we will guide you through each step of your claim and advise you on how to gain a swift resolution. It's our aim to take the stress out of what's likely to be an already stressful situation. Simply give us a call and we’ll take it from there.

If you would prefer to spread the cost of your rowing boat insurance policy, you have the option of setting up a Direct Debit to pay your premium by monthly instalments through our preferred provider, Premium Credit Limited (PCL).

To find out more about PCL and direct debit payments, select Direct Debit.

To understand more about how PCL work together with Towergate, please read our Regulatory Information.

We have provided a summary of the key features of the policy, above. For details of the terms and conditions applicable, please refer to the insurance product information document and policy wording, which are available during the quotation process.

See our range of cover

Motor boat insurance articles

06/01/2015

The Difference Between Motorboat and RIB Insurance

Find out more about the differences between motorboats and RIBs and why we offer two separate insurance policies in Towergate’s useful video guide.

Read more03/02/2017

Anatomy of a Powerboat: Guide to a Powerboat

Interested in powerboats? Take a look at our detailed article, covering the history of motor boats, superyachts, Boaty McBoatface, and more examples.

Read more24/10/2013

Chartering Your Boat

Chartering your boat is a good way to increase income. But to be compliant, you must insure your boat before renting it to anybody. This article covers the key facts to get you started.

Read more