How New Government Policy Is Impacting The Care Sector

As we approach the new financial year, we look at how the increase in National Minimum Wage (NMW), National Living Wage (NLW) and National Insurance will impact those in the care sector.

Increases in National Minimum Wage and National Living Wage

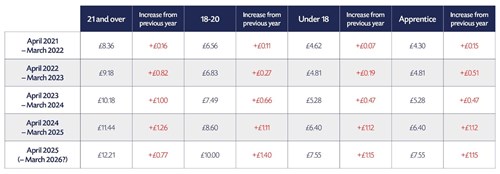

In October 2024, the Government announced it would increase the National Minimum Wage and the National Living Wage.

The National Living Wage applies to those aged 21 and over, while the National Minimum Wage applies to those between the school leaving age and 20 years old1.

Although an annual wage increase has come to be expected each March, this coupled with the increase in National Insurance for employers has put a financial strain on the care sector.

Changes in National Insurance

From 6 April 2025, there will be a number of changes taking place to National Insurance2. The key updates include:

• The National Insurance contributions (NICs) rate for employers will increase 1.2% from 13.8% to 15%.

• The employer’s NI Secondary Threshold will decrease from £9,100 to £5,000.

• The maximum Employment Allowance will more than double from £5,000 to £10,500.

• The removal of the £100,000 eligibility restriction for the Employment Allowance, meaning all eligible businesses and charities can claim a greater reduction on their secondary Class 1 NICs liability regardless of what they were in the previous tax year.

These changes to National Insurance will result in a greater financial burden for many businesses, which many SMEs, including those in the care sector, will struggle to pay.

How this will impact the care sector

Following the announcement of these changes, the care sector voiced its concerns that this would create a huge amount of pressure for the industry. The autumn budget specified that the NHS would be exempt from the rise, however this exemption did not extend to private healthcare, charity-run healthcare or GP surgeries3.

Last month, Lord Howard of Lymphe, vice-president of Hospice UK’s board of trustees, estimated that these additional contributions would cost an extra £34m per year for hospices4.

Charity Marie Curie wrote to health secretary West Streeting that the increase to NIC would cost them an additional £3m annually and that they would need to reduce their services if they did not get further support5.

On 26 February, the House of Lords voted to make social care providers exempt from the increase to employers’ national insurance contribution6.

Homecare Association influencing and campaigning

The Homecare Association took immediate action following the Chancellor's Autumn Statement on 30 October 2024, which introduced two measures that severely threaten the sustainability of care services: an increase in employers' National Insurance contributions and a significant rise in the National Living Wage.

Their policy team calculated these changes will add an average £2.04 per hour to direct staff costs in homecare. This brings total direct staff costs to around £22.71 per hour - a 9.9% increase over 2024/25. This is reflected in their Minimum Price for Homecare 2025/26, which calculates the minimum fee rate for sustainable homecare services at £32.14 per hour.

The Homecare Association has worked hard to influence central and local government to provide more funding for homecare to cover the costs of Budget measures. The amount allocated by the government increased to £880 million as a result.

They have also joined with care providers in the 'Providers Unite' campaign, warning of an impending 'systematic collapse of community care services across Britain' without additional funding. Their recent Care Provider Alliance survey found that without immediate intervention, 73% of providers will have to refuse new care packages, 57% will hand back existing contracts, and 22% are planning to close their businesses entirely.

How does Towergate believe this will impact the care sector in terms of insurance?

It has been suggested that in light of these new financial strains, SMEs will be forced to cut back on ongoings. For some, this may mean only taking out business interruption insurance for 12 months rather than 24 months or reducing the amount their property is insured for resulting in underinsurance.

For others, it may result in businesses cutting costs on optional covers such as cyber insurance, management liability insurance and directors and officers insurance, thereby making themselves vulnerable to these risks – which could end up costing them more in the long run.

What costs are you cutting back on?

To share your thoughts please contact us:caremarketing@towergate.co.uk

Sources:

- National Minimum Wage and National Living Wage rates - GOV.UK

- Changes to the Class 1 National Insurance Contributions Secondary Threshold, the Secondary Class 1 National Insurance contributions rate, and the Employment Allowance from 6 April 2025 - GOV.UK

- Lords vote to scrap NI hike for hospices, care homes and others | Nursing Times

- Lords vote to scrap NI hike for hospices, care homes and others | Nursing Times

- Government expected to help UK hospices hit by national insurance rise | Health policy | The Guardian

- Lords vote to exempt social care from NICs hike | Local Government Chronicle (LGC)

About the author

Carolyn Baker-Mellor is a respected industry leader with over 35 years' experience within the care insurance sector.

Carolyn Baker-Mellor is a respected industry leader with over 35 years' experience within the care insurance sector.

Carolyn currently works at Towergate as Head of Care Insurance.

Date: April 15, 2025

Category: Care and Medical