Do I Need Landlords Insurance?

Investing in a rental property can be a rewarding endeavour, offering a steady income stream and the promise of future returns. However, with this opportunity comes a significant responsibility. To protect your investment and secure your financial future, understanding the importance of landlords insurance is crucial.

Here, we’ll delve into the world of landlord insurance, exploring the types of coverage available, its benefits, and whether it is a legal requirement. Whether you're a seasoned landlord or considering your first rental property, this guide will help you make an informed decision about protecting your assets and income. So, let's start by taking you through the different types of landlord insurance available.

Types of landlord insurance

We offer a range of insurance options tailored to your specific needs, including insurance for:

- Single-property landlords: Ideal for those with a single rental property.

- Multi-property landlords: Coverage for landlords with multiple properties.

- Tenants: Protection for your tenants living in your rented property

- Landlords with DSS tenants: Tailored coverage for properties with DSS tenants.

- Landlords with students and houses of multi-occupation: Insurance designed for student housing and multi-occupancy properties.

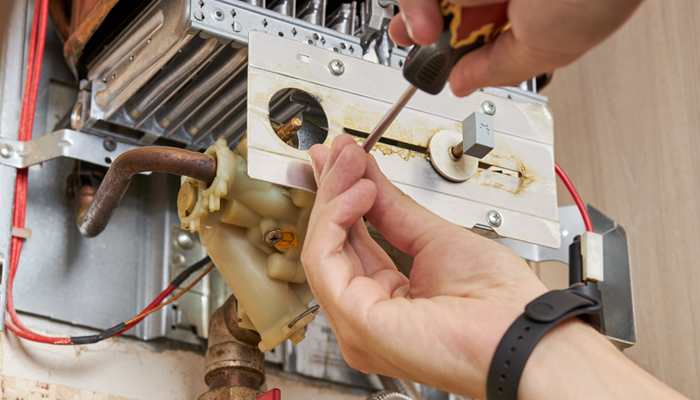

- Home emergency and boiler cover: Extra peace of mind for unexpected situations.

Benefits of landlords insurance

Landlords insurance provides protection for your property, covering both the building and contents of communal areas (Cover limits apply and you should check to make sure you have the right level of cover and are not underinsured. By having this insurance, you safeguard your investment against unforeseen damage and financial loss from a range of specified perils including fire, flood and storm amongst others.

For landlords letting on a furnished basis, landlords contents insurance cover is available, ask us for details.

Why do I need landlord insurance?

While landlord's insurance isn't a legal requirement, it is a safeguard against significant risks. Some mortgage lenders may make it a condition for your buy-to-let property investment. Here's why it's a smart choice:

- Protection from property damage: Insure your property against damage to the building and its contents.

- Peace of mind: Ensure that your property is secured even in the face of unforeseen events.

What is the difference between landlord insurance and standard home insurance?

You might not view your rental property as a business, but for insurance purposes, it is. While both types include buildings insurance, home insurance is often inadequate for rental properties. Landlord insurance offers essential additional coverage, including property owners’ liability, and loss of rent options. Additional options are available for landlords such as legal expenses insurance and rent guarantee cover.

Furthermore, failing to notify your home insurer about your rental activities could invalidate your home insurance. To protect your income and property assets, opting for landlord insurance is a wise choice when renting out your property.

Is landlord insurance a legal requirement?

While it's not a legal requirement, your mortgage lender may insist on it to protect their interest in the mortgage they have provided on your buildings.

If you are a limited company or employ and supervise staff directly then you will need employers liability insurance. This is compulsory by law and protects if employees are accidentally injured while working for you and claim it was your fault. Legal defence costs as well as any compensation awards if you are found to be responsible.

What happens if I don't have landlords insurance?

Owning a property without insurance leaves you vulnerable to substantial losses in the event of a major incident like fire, storm, or flood. The implications go beyond just property damage; consider the loss of rental income during the period your property is uninhabitable.

Rebuilding a property after a major incident can be a lengthy process with unforeseen delays, such as weather or material shortages. In some listed properties, unexpected archaeological discoveries during foundation excavation can cause further delays. Protect your investment by securing a landlord insurance policy, even though it's not legally required.

How much does landlord insurance cost?

The cost of your landlord insurance will depend on many factors. Everything from the type of cover you need, to the property’s location, construction, occupation and values to be insured.

See more information on our landlord insurance page.

What if my tenant has renters insurance?

Remember, that a renters' insurance is arranged by your tenant and covers your tenant's personal belongings and their contents only. To protect your own property, including any contents you provide, you need to arrange your own landlord's contents insurance.

Can I use my homeowners insurance for rental property ?

No, you must inform your insurers before you decide to let your property to make sure that the correct insurance cover is arranged.

Also, some mortgage lenders may require you to purchase landlord insurance if you intend to rent out your property to tenants.

Landlords insurance from Towergate

We offer landlord insurance options for a variety of property types and tenant situations, including multi-occupancy, student housing, local authority placements, and more. Head over to our landlords insurance webpage to explore what options are available or call 0333 060 0915 for more information.

Commercial property insurance from Towergate

Explore our commercial property insurance options, covering various commercial properties from our network of trusted insurers. Whether you have a single property or an entire portfolio, we can provide the coverage you need.

Ready to take the next step towards insuring your property? Why not request a quote, call us on 0330 828 0512 or request a callback.

About the author

Alison Wild BCom (Hons), FMAAT, MATT, Taxation Technician is a highly respected industry professional who has been working with and advising SMEs in areas including tax, pensions, insurance and marketing for over 25 years. She is a member of the Association of Accounting Technicians (AAT) and Association of Tax Technicians (ATT) and also has 20 years' experience as a residential landlord.

Alison Wild BCom (Hons), FMAAT, MATT, Taxation Technician is a highly respected industry professional who has been working with and advising SMEs in areas including tax, pensions, insurance and marketing for over 25 years. She is a member of the Association of Accounting Technicians (AAT) and Association of Tax Technicians (ATT) and also has 20 years' experience as a residential landlord.

The information contained in this article is based on sources that we believe are reliable and should be understood as general information only. It is not intended to be taken as advice with respect to any specific or individual situation and cannot be relied upon as such.

Date: June 21, 2024

Category: Landlords