Loss Gross Profit Versus Increased Cost of Working Cover

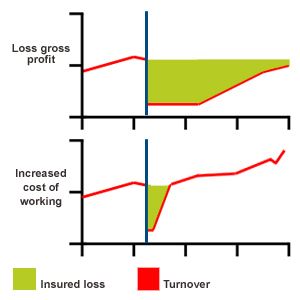

What is ‘loss gross profit’ Insurance?

'Loss of gross profit' and 'increased cost of working' cover are types of business interruption insurance. But how do they work and how are they different? We look into each to help you decide which is right for your business.

Take this example: A fire destroys your office and puts your business out of action. You have insured your stock and contents, maybe your building too, so these will be replaced under the sums insured. But while you’re out of action, you aren’t making any profit and your business isn’t growing.

Loss of gross profit cover is in place to pay your rent, wages and all necessary over-heads whilst you are unable to trade.

Once you’re back in your premises and trading again, your business insurance will continue to cover your expenses while you recover but it could be months or years before you can get back to the point you were at before the incident. Inevitably the longer you are out of action or spending resource on recovering, the longer you go without growing. Your business insurance can’t pay-out forever and even if you claim for every loss you suffer, you’re not making profit and the fall out, even after you’re up and running can keep costing you for years to come.

What is ‘increased cost of working’ insurance?

For a business with simple needs such as an office (computers, desk, telephones etc.) and no specific equipment or location requirements ‘increased cost of working’ is often a much more attractive feature and can cost less too (mostly because of the lower cost to the insurance company, and typically a lower sum Insured). The insurer will find you suitable new premises, re-stock the contents and have you up and running, sometimes in as little 3 days. You can continue your business, not lose customers or stop vying for new ones, all while staying active in your market place and experiencing as little disruption as possible.

Indemnity Period – This is the amount of time you can claim for business interruption insurance. Most commercial policies are set at 24 months as standard, and the minimum is 12 Months with most insurers. If you have specific needs which could require a longer time you should discuss your requirements with your insurance adviser. (e.g. sourcing a bespoke built piece of equipment that could take a year to manufacture and deliver)

However, it’s not suitable for all businesses. For example, a business with a shop front would need similar premises because they may count on the footfall in a specific area or a printing office may use very specific pieces of equipment that allows them to fulfil their customers’ demands. It is very important that you have this discussion with a qualified, specialist adviser who will help you make this decision.

Business insurance from Towergate

Whether you’re a large business, SME or sole trader, work from home or have a property empire - Towergate have got an insurance policy for you. For more information, visit our dedicated business insurance page.

About the author

Alison Wild BCom (Hons), FMAAT, MATT, Taxation Technician is a highly respected industry professional who has been working with and advising SMEs in areas including tax, pensions, insurance and marketing for over 25 years. She is a member of the Association of Accounting Technicians (AAT) and Association of Tax Technicians (ATT) and also has over 20 years' experience as a residential landlord.

Alison Wild BCom (Hons), FMAAT, MATT, Taxation Technician is a highly respected industry professional who has been working with and advising SMEs in areas including tax, pensions, insurance and marketing for over 25 years. She is a member of the Association of Accounting Technicians (AAT) and Association of Tax Technicians (ATT) and also has over 20 years' experience as a residential landlord.

Date: August 20, 2021

Category: Other