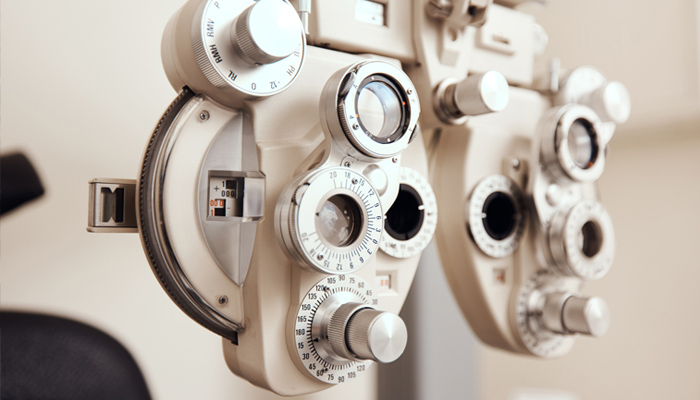

See our range of care and medical cover

Care and Medical Insurance FAQs

![Question Question]()

How do I know how much care and medical insurance cover I need?

How do I know how much care and medical insurance cover I need?

For their own liability reasons you are unlikely to find an insurance company who will advise you on how much cover you need. It is your responsibility to take out adequate cover although our advisers can go through your options over the phone and explain how you might want to calculate this cost. Alternatively, many industry organisations or professional bodies will likely be able to offer you general advice.

![Question Question]()

I only work from home, do I still need care and medical insurance?

I only work from home, do I still need care and medical insurance?

Professionals who send out products, offer advice, or provide some services from their own home can still cause harm for which they may be liable. For this reason it’s important you don’t make an assumption that you can’t do any damage when working from your own home, and speak with an adviser about your risks.

![Question Question]()

What happens if I retire or cease trading?

What happens if I retire or cease trading?

When you stop trading, or retire, we recommend you still have something called ‘run off’ cover. This means that claims raised against you for an event that happened while you were still trading are covered (a claim can be raised any time up to 3 years after the fact). When you are ready, we can arrange cover for you for this.

![Question Question]()

If a member of staff loses the keys to the domiciliary care service user's home, does my policy cover this?

If a member of staff loses the keys to the domiciliary care service user's home, does my policy cover this?

The reasonable costs of replacement locks are covered under your policy.

![Question Question]()

If an employee was found to have stolen property or money belonging to a domiciliary care service user, would our policy cover this?

If an employee was found to have stolen property or money belonging to a domiciliary care service user, would our policy cover this?

Yes. Cover is provided up to a maximum of £25,000, if you are legally liable.

![Question Question]()

What is the Stress Helpline and who can use it?

What is the Stress Helpline and who can use it?

The Stress Helpline is a 24-hour confidential telephone helpline and is available for you or any employee of your business to use.

![Question Question]()

What additional benefits are available to Homecare Association members?

What additional benefits are available to Homecare Association members?

All Homecare Association members who take out a domiciliary care policy with Towergate will receive a 10% discount off our standard premium*. In addition, as part of the core policy you will receive the driver safety e-learning module and a risk management audit; We also offer a members business benefits package including; directors' and officers' liability insurance, motor fleet, mortgage advice, pensions and other financial products and a staff benefits package including; household, travel and mortgage advice?

*Discount is applied before IPT and customer service charge. All cover is subject to insurers terms and conditions.

![Question Question]()

Do I receive a discount as a member of other professional associations?

Do I receive a discount as a member of other professional associations?

Many of our customers can get a discount on their insurance simply by being a member of a professional association or industry body. What’s more, for many of these, we also offer profession specific policies too. This means you can get specific cover with discounts! Speak to one of our advisers to find out how much you can save.

![Question Question]()

Will legal advice be offered by trained solicitors or barristers, with experience within the care sector?

Will legal advice be offered by trained solicitors or barristers, with experience within the care sector?

Yes, all enquiries are handled by a dedicated team specialising in care. Legal advice is only given by qualified solicitors and barristers and the claims team are all qualified with a law degree as a minimum.

![Question Question]()

Does my domiciliary care policy include abuse cover?

Does my domiciliary care policy include abuse cover?

Yes. The policy does not exclude abuse and will protect you where you are legally liable for allegations made against you of sexual, mental and physical attacks on service users.

![Question Question]()

Is there anyone in your company to help us with registration issues that we may encounter?

Is there anyone in your company to help us with registration issues that we may encounter?

We have an independent registration consultant retained solely by us, who helps our clients with any queries they may have. Our legal helpline can also assist you in keeping your business operational.

![Question Question]()

Do I need separate liability insurance for a care fundraising event I am organising?

Do I need separate liability insurance for a care fundraising event I am organising?

Most fundraising events are automatically covered by the charity liability insurance section of our policy, but for others we may need additional information to provide you with adequate cover.

![Question Question]()

Do I need to extend my care policy to cover the changes in the Corporate Manslaughter Act?

Do I need to extend my care policy to cover the changes in the Corporate Manslaughter Act?

No, you do not need to extend your policy. Corporate Manslaughter Defence Costs cover has been included within our policy since the Act came into force in 2008.

Are care volunteers covered?

![Question Question]()

Are care volunteers covered?

Are care volunteers covered?

Yes, our definition of an employee includes both paid and volunteer members of staff, hence cover is extended to volunteers in all relevant sections of your policy.

![Question Question]()

How can I pay for my care and medical insurance premium?

How can I pay for my care and medical insurance premium?

You can pay by credit card, debit card or monthly direct debit.

![Question Question]()

Can I pay in instalments?

Can I pay in instalments?

Yes. If you would prefer to spread the cost of your policy, you have the option of setting up a direct debit to pay your premium in equal monthly instalments through our preferred provider, Premium Credit Limited (PCL).

![Question Question]()

Where can I find more information about monthly Direct Debit for liability cover?

Where can I find more information about monthly Direct Debit for liability cover?

If you would like to know more about our monthly payment option, please visit our dedicated Direct Debit page.

Read Care and Medical Insurance Articles

-

Mitigate the Cyber Risks for Care Businesses Using Cloud Based Services

The risk of cyber crime is increasing, and care and medical organisations are no exception. Find out how to protect your business against this threat.

Read MoreJuly 31, 2020

-

Top Tips for Renewing your Care Business Insurance

Read our top tips for renewing your business insurance.

Read MoreMarch 11, 2021

-

Are you ready to scale up your business?

When your company is thriving, you may consider scaling up. This article looks at key considerations to take into account when scaling up your business.

Read MoreMarch 21, 2016

-

Business Insurance Checklist

Get the best business insurance. Our checklist will help you understand what makes the best business insurance and what you can do to be best protected.

Read MoreApril 17, 2015

-

Making Tax Digital for Businesses

Making Tax Digital (MTD) will affect all businesses and is a key element of the government’s plans to make it easier for businesses and individuals.

Read MoreNovember 25, 2020